Posts

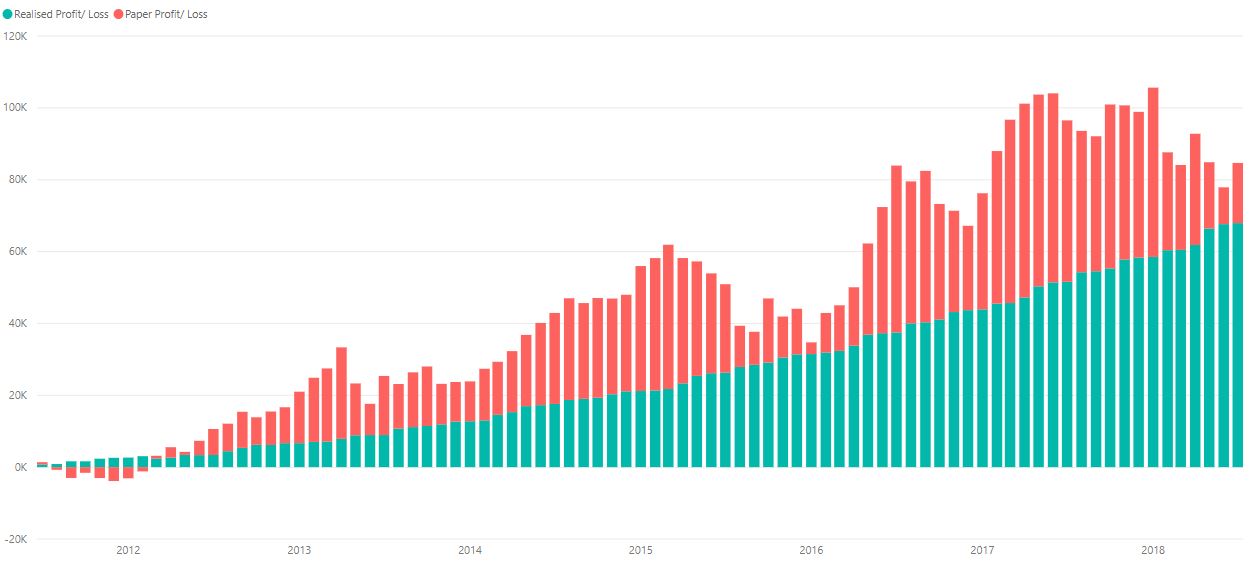

Portfolio Realized and Unrealized Profit

Portfolio has recovered slightly from the drop due the property cooling measures and trade war but the Singapore market remains weak. Currently looking at Finance and Property sectors.

- Get link

- X

- Other Apps

Opinion on Robo-Advisor

OCBC has jumped onto the bandwagon to introduce robo-advisor service with a high management fee of 1.5%. Regardless of whether you seek a human financial advisor or a robo-advisor, their primary goal is to earn money from you either through selling of financial products or fees. Take note that the…

- Get link

- X

- Other Apps

Review on Investment Blogs

The following are some of the blogs which I read and my opinion of them. There are many other blogs which I also read to learn from their portfolio composition and to look for investment ideas. Financial HorseFinancial Horse is currently my most read investment blog which has many articles with goo…

- Get link

- X

- Other Apps

Portfolio Sector Diversification

REIT remains the largest holding in my portfolio. Geographical diversification is not so much of a concern as most stocks are already diversified across countries.

- Get link

- X

- Other Apps

Dividend Collected 2018

My primary objective for investing has always been about dividend income stream and capital appreciation been secondary. This should not be taken as blindly going after high dividend yield.

- Get link

- X

- Other Apps

My Thoughts on Cryptocurrency

The first thing is to understand that blockchain technology or distributed ledger technology is not cryptocurrency. Distributed ledger technology is used by some cryptocurrencies but there are many other applications for it. If you think that there is great potential in the technology, it should n…

- Get link

- X

- Other Apps

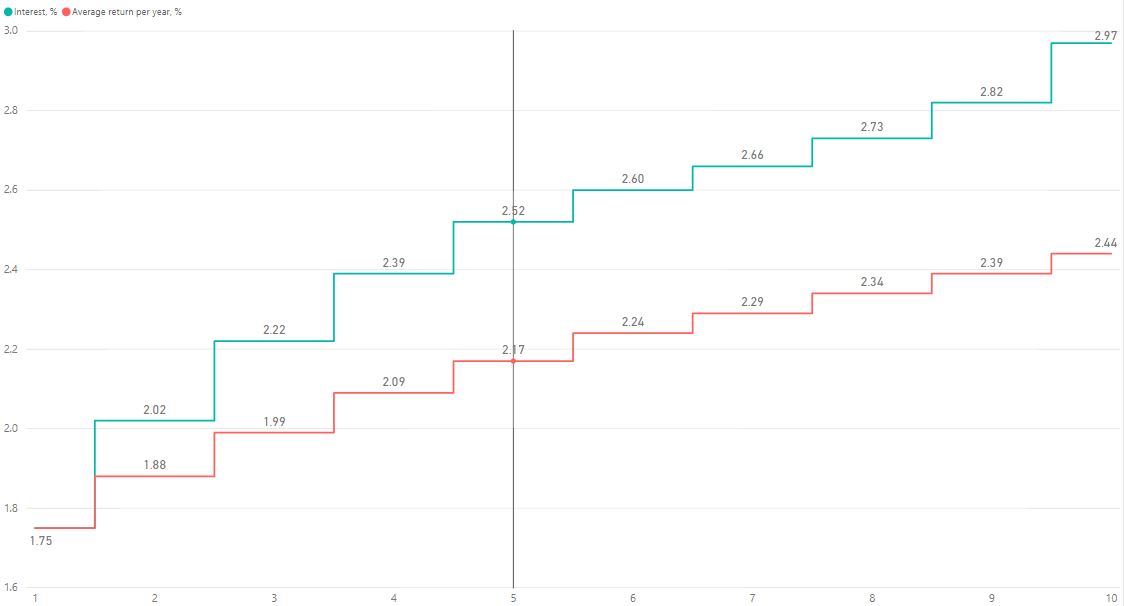

Singapore Savings Bonds September 2018

I will probably not be adding any SSB until the next interest hike in September. Around 3.6% of my portfolio is currently in SSB.

Details on this month SSB can be found on SGS website.

- Get link

- X

- Other Apps

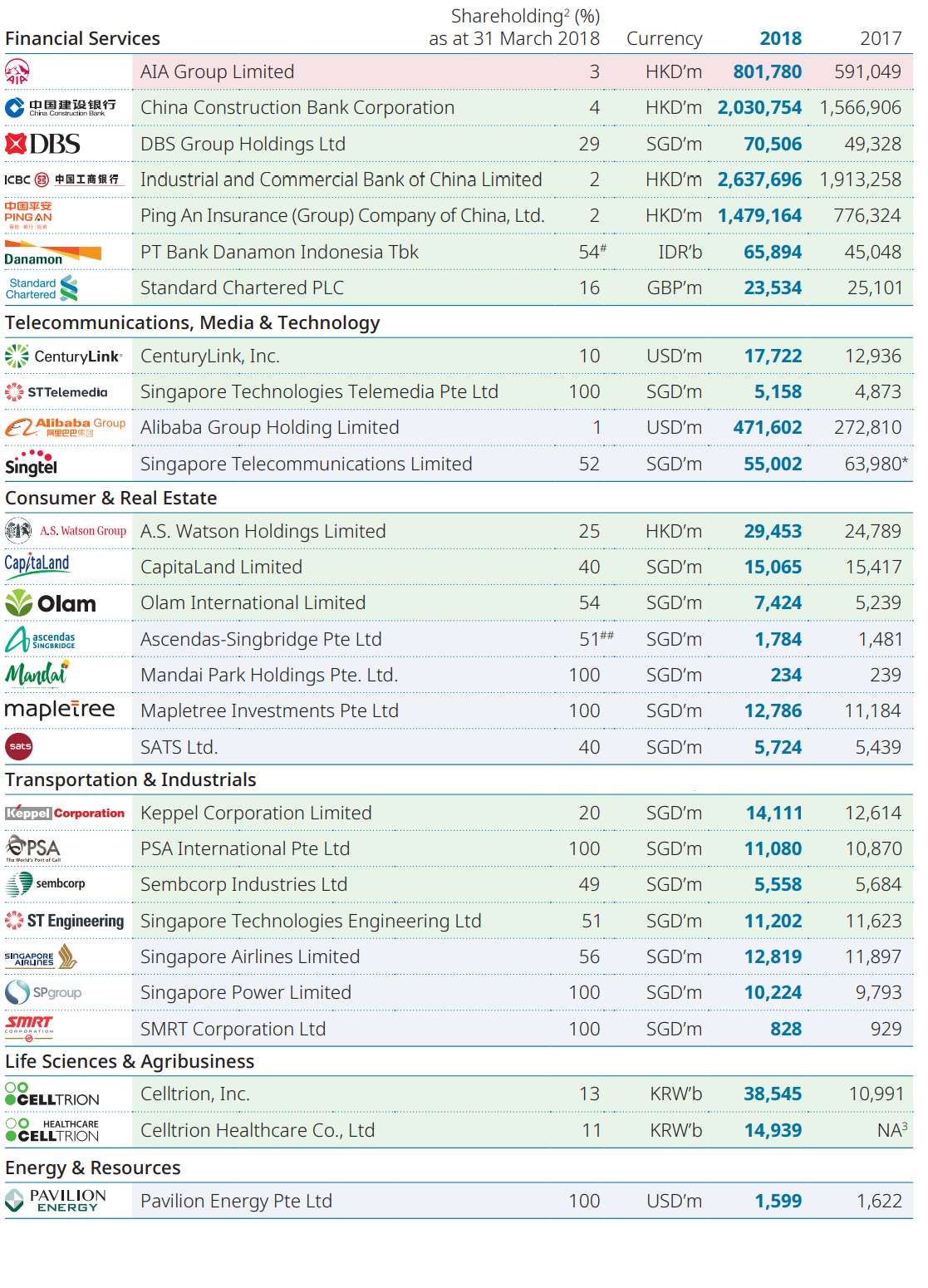

Does Temasek manages our CPF? Temasek Overview 2018 Key Takeaway

Simply NO. Our CPF is used to purchase Special Singapore Government Securities (SSGS) issued by the Singapore Government. The proceeds are pooled together with proceeds from other sources and then invested via MAS and GIC. GIC is a fund manager, and not an owner of the assets. Source: MAS

Temasek,…

- Get link

- X

- Other Apps

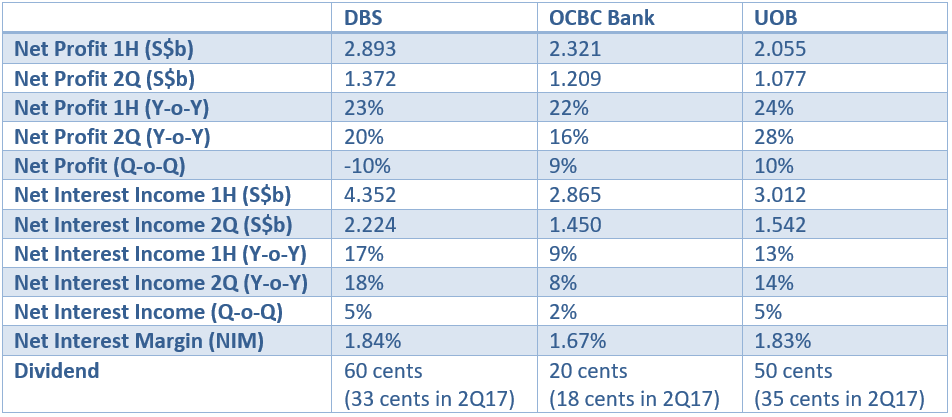

DBS, OCBC, UOB 2Q/1H18 Results Comparision

In general, all 3 banks did well for 1H18 compared to a year ago. It's really hard to say which is the best bank to hold so I will probably hold all 3 banks in the future when there is opportunity to enter. Currently, I only have OCBC Bank in my portfolio.

- Get link

- X

- Other Apps

Quick Thoughts on Nikko AM SGD Investment Grade Corporate Bond ETF and Synagie

Nikko AM SGD Investment Grade Corporate Bond ETF I have read a few reviews online and the main concern is the naming of the fund, Nikko AM SGD (which may includes SGD-denominated foreign bond, 'non-Index') Investment Grade (includes unrated bonds) Corporate (includes quasi-sovereign bonds)…

- Get link

- X

- Other Apps

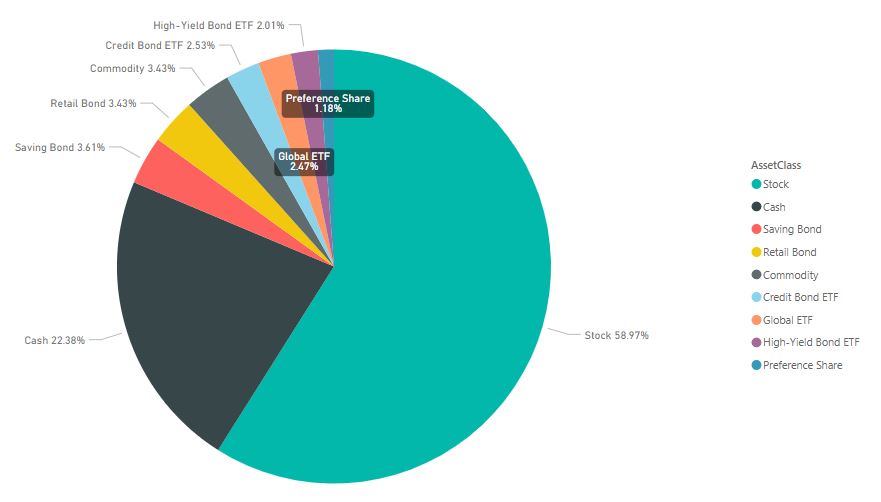

July 2018 Portfolio and Stock Allocation

Change log Added Singapore Savings Bonds Change log Added OCBC BankAdded ST Engineering

- Get link

- X

- Other Apps