Posts

Featured

Latest Posts

Consolidated Portfolio Updates - September 2021

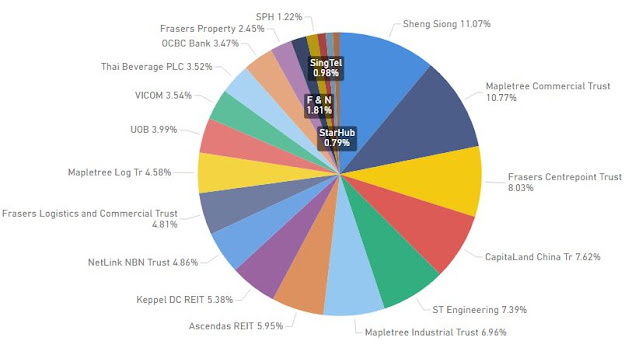

Core Stock Allocation Total Portfolio Allocation

Satellite Portfolio Allocation Dividend Collected to Date Dividend Collected in 2021 Dividend by Month (Last 5 Years) Top Dividend Contribution (Last 12 Months) Total Portfolio P&LPortfolio Market Value

Transaction Summary for September2021BOUGHT S&…

- Get link

- X

- Other Apps

Portfolio Performance Review (August 2021)

Total Portfolio P&LSince Inception

Total Portfolio Unrealized Gain: $69.77K Total Portfolio Realized Gain (Including Dividends): $154.72K XIRR: 7.31% Portfolio Market Value

The sentiment in the market has started to turn bearish as lesser people are buying the dip. The tapering will start soon in t…

- Get link

- X

- Other Apps

Dividend Collected (August 2021)

Dividend Collected to Date Dividend Collected in 2021 Dividend by Month (Last 5 Years) Top Dividend Contribution (Last 12 Months) Dividend collected for the month of August 2021: $2.73K* *Dividends are realized on pay date SINGTELFRASERS L&C TROCBC BANKUOBSHENG SIONGST ENGINEERINGSTARHUBVICOM LTD Divi…

- Get link

- X

- Other Apps

Portfolio Allocation Review (August 2021)

Core Stock Allocation Total Portfolio Allocation Satellite Portfolio Allocation

Transaction Summary for August 2021 BOUGHT NIKKOAM STC ASIA REIT ETF (SRS)BOUGHT ISHARES USD ASIA HY BOND ETF (SRS)BOUGHT AMDBOUGHT VANGUARD HEALTH CARE ETFBOUGHT MICRON TECHNOLOGYBOUGHT TESLAThe China’s economy shake up i…

- Get link

- X

- Other Apps

Satellite Portfolio Allocation

Satellite Portfolio Allocation

Holdings Vanguard Health Care ETF, VHTInvesco QQQ Trust, QQQiShares China Large-Cap ETF, FXIASML Holding NV, ASMLMicron Technology, MUTaiwan Semiconductor Manufacturing Company, TSMCTesla Motor, TSLANvidia Corp, NVDA Advanced Mirco Device, AMDThe clampdown of China com…

- Get link

- X

- Other Apps

Portfolio Performance Review (July 2021)

Total Portfolio P&L

Since Inception

Total Portfolio Unrealized Gain: $77.87K Total Portfolio Realized Gain (Including Dividends): $151.98K XIRR: 7.58% Portfolio Market ValueIt’s a pretty uneventful week so I won't be doing an update for this

week. Tiger Broker Referral Futu MooMoo Referral Investi…

- Get link

- X

- Other Apps

Dividend Collected (July 2021)

Dividend Collected to Date Dividend Collected in 2021 Dividend by Month (Last 5 Years) Top Dividend Contribution (Last 12 Months)

Dividend collected for the month of July 2021: $0.95K* *Dividends are realized on pay date ISHARES USD ASIA HY BOND ETFISHARES USD ASIA BOND ETFNIKKOAM SGBD ETF Dividend (YTD):…

- Get link

- X

- Other Apps

Portfolio Allocation Review (July 2021)

Core Stock Allocation Total Portfolio Allocation

Satellite Portfolio Allocation Transaction Summary for July 2021 BOUGHT TESLABOUGHT ASML HOLDING NVBOUGHT NVIDIA CORPSOLD CAPITALAND MAS has finally lifted the dividend cap for banks, but the news probably has already been priced in and the prices barely…

- Get link

- X

- Other Apps

Satellite Portfolio Allocation

Satellite Portfolio Allocation HoldingsVanguard Health Care ETF, VHTInvesco QQQ Trust, QQQiShares China Large-Cap ETF, FXIASML Holding NV, ASMLMicron Technology, MUTaiwan Semiconductor Manufacturing Company, TSMCTesla Motor, TSLANvidia Corp, NVDA There are quite abit of changes for the growth (sate…

- Get link

- X

- Other Apps

Portfolio Performance Review (June 2021)

Total Portfolio PnL

Since Inception

Total Portfolio Unrealized Gain: $72.52K Total Portfolio Realized Gain (Including Dividends): $147.79K XIRR: 7.42% Portfolio Market Value Total profit reached all-time high in June as I took profit and exited my Semi-Con ETF and switched to holding individual stocks i…

- Get link

- X

- Other Apps