Posts

2018 Year-End Reflection and Game Plan for 2019

In the blink of an eye, 2018 will be over soon and another year has passed. This year has been a big drought for IPO as none has attracted my attention. IPO aside, there were a other few listing which I applied for, namely, Astrea IV4.35%B280614, Temasek 2.7% 231025XB and the NikkoAM SGD IGBond. T…

- Get link

- Other Apps

2.01% Jan 19 Singapore Savings Bond. Really that good?

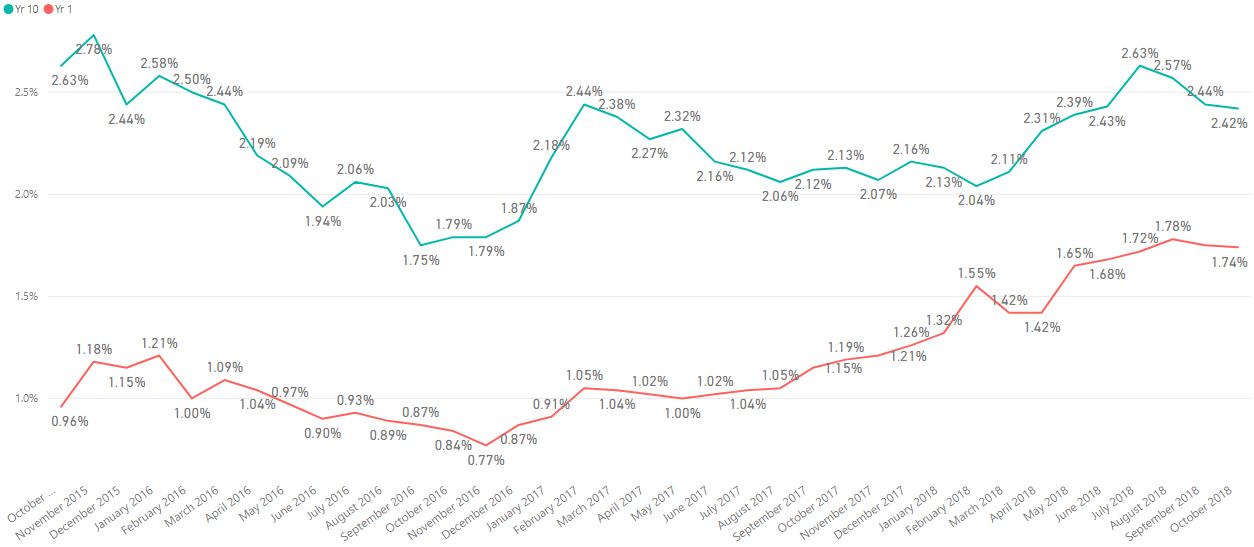

The Singapore Saving Bond's interest rate for 1 year holding has been making new high for the past three consecutive months. The issue in Jan 19 is not only a new high but it is also the first time the rate has exceeded 2%. Sounds attractive?

In fact, the Jan 19 issue may not be that attractiv…

- Get link

- Other Apps

November 2018 Portfolio Results

Overall portfolio is still with positive unrealized gains. November was a much better month as compared to October as unrealized gains increased slightly after the recovery from Red October. Dividend collected was also slightly higher in November.

Market remains pessimistic as negative news cont…

- Get link

- Other Apps

Step-by-Step Guide to Application/ Redemption of Singapore Savings Bonds

The reason I am doing a simple step-by-step guide on how to apply and redeem Singapore Savings Bonds is because I received a few comments from my previous posts suggesting that it is not worth the effort to swap the bonds. I was quite puzzled as both application and redemption can be done easily u…

- Get link

- Other Apps

9% Interest for 1 Year. Good Deal or No Deal?

Recently, Facebook pushed one of the following advertisement to me, an investment offering 9% interest over 1 year period. As a financial blogger, I took a deeper look and decided that I should do a quick review.

The investment is offering 0.75% interest each month for 12 months. The total intere…

- Get link

- Other Apps

November 2018 Dividend Collected

Dividend payout for the month of November 2018

MAPLETREE LOG TR 800 SUPER OXLEYMTNB200518 MAPLETREE NAC TR NETLINK NBN TR FRASERS CPT TR MAPLETREE COM TR FRASERS CPT TRSTARHUB

Dividend collected for the month is lower than what I had expected. The main reason is due to 800 Super cutting their divid…

- Get link

- Other Apps

November 2018 Portfolio Updates

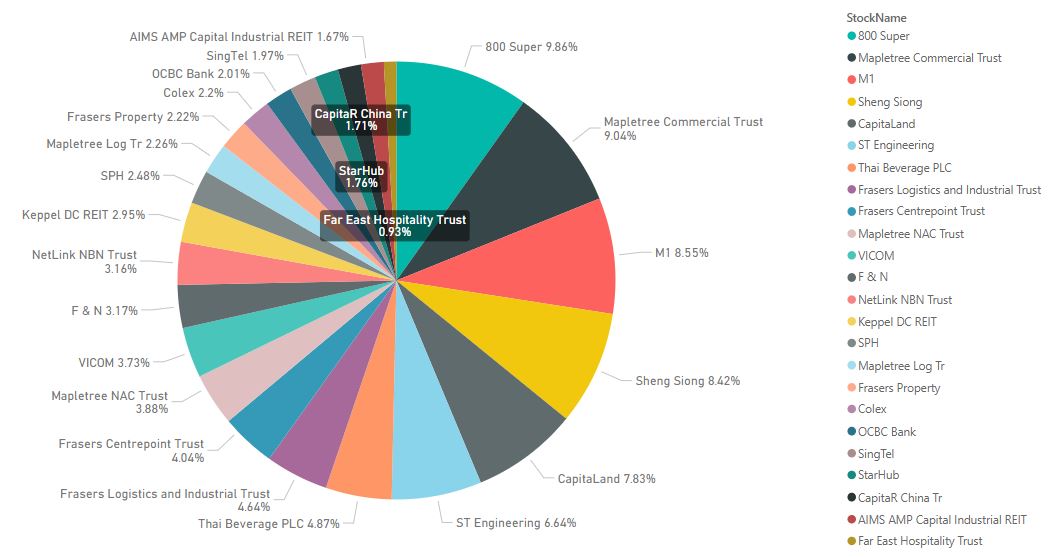

Stock Allocation There was no stock transaction for the month of November 2018 yet again. November was a much better month as compared to the month of October. The Fed chairman made a comment that interest rate is close to neutral, suggesting that the rising rate could be slower and smaller over n…

- Get link

- Other Apps

Should You Switch to December 2018 Singapore Savings Bonds?

This month SSB has again reached another high since inception at 1.89% interest for a holding period of 1 year. Not only did the short term interest rate raised, the long term interest rate for holding 10 years had also raised to 2.57% from the previous month. This makes the current issue of SSB m…

- Get link

- Other Apps

October 2018 Portfolio Results

In October, the STI had fallen by 7.32% which almost wipeout all of the unrealized gains for my portfolio. Luckily, my portfolio still manages to close with a small unrealized gain at the end of the month. Despite the fall, I am still comfortable to hold on to my portfolio as the dividends collect…

- Get link

- Other Apps

October 2018 Dividend Collected

Dividend payout for the month of October 2018

OCBC BANKPERENNIALN181023

Average Monthly Dividend (YTD): $1,385

Target Total Dividend for 2018: $16,000

October is a relatively quiet month for dividends. We are looking forward to November where bulk of the dividends payment will be made, especially f…

- Get link

- Other Apps

October 2018 Portfolio Updates

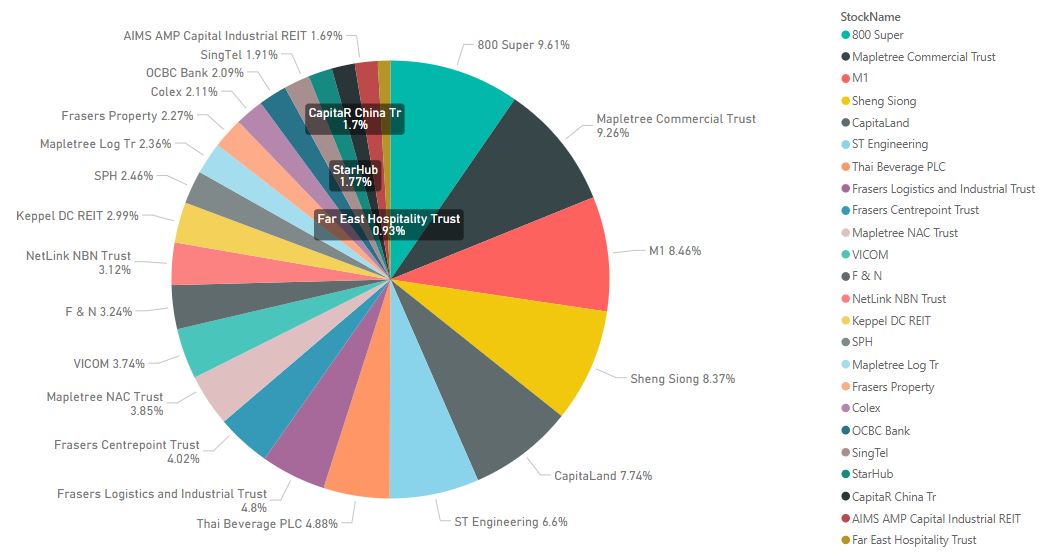

Stock Allocation

There was no stock transaction done for the month of October 2018. This is the month of Red October where STI has fallen below the support of 3000 points. But fortunately on the last day of the month, the market show signs of rebounding and managed to close slightly above it. Head…

- Get link

- Other Apps

Opinion on Factor-Based Investing Strategy

Recently, I came across the term 'factor-based' investing and decided to take a deeper look on whether this strategy could be applied to my investment portfolio.

Factor-based or risk-weighted investing is a diversification strategy that determines how one should allocate stocks in their p…

- Get link

- Other Apps

Singapore Savings Bonds as Pseudo-Savings Account

The 1-year interest rate for this month SSB has reached the highest at 1.80% since inception. The increase is in tandem with the increase in interest rates by the US Federal Reserve. We are still looking at a flattening yield curve trend as the short term rates are catching up with the long term r…

- Get link

- Other Apps

5-Year T2023-S$ Temasek Bond Buy! Buy! Buy!

This is the first time Temasek has offered a 5-year bond, T2023-S$, which will be listed on the SGX and made available to the public. The offer is up to S$400 million, with potential upsize to S$500 million if oversubscribe. The bond has an interest rate of 2.70% per annum payable semi-annually. A…

- Get link

- Other Apps

Updates on Portfolio Realized and Unrealized Profit

My portfolio has swung back into the positive region from last month bad result due to the fall of 800 Super. This month, the spotlight is now on M1 as Keppel and SPH bid for majority control over M1. The general offer price of $2.06 is at 26% premium of the closing price before trading was halted…

- Get link

- Other Apps

September 2018 Dividend Collected

Dividend payout for the month of September 2018

MAPLETREE LOG TRFAR EAST HTRUSTCAPITAR CHINA TRAIMSAMP CAP REIT

Average Monthly Dividend (YTD): $1,463

Target Total Dividend for 2018: $16,000

In my previous post, I have compared my portfolio to the Morningstar® Singapore Yield Focus Index and both p…

- Get link

- Other Apps

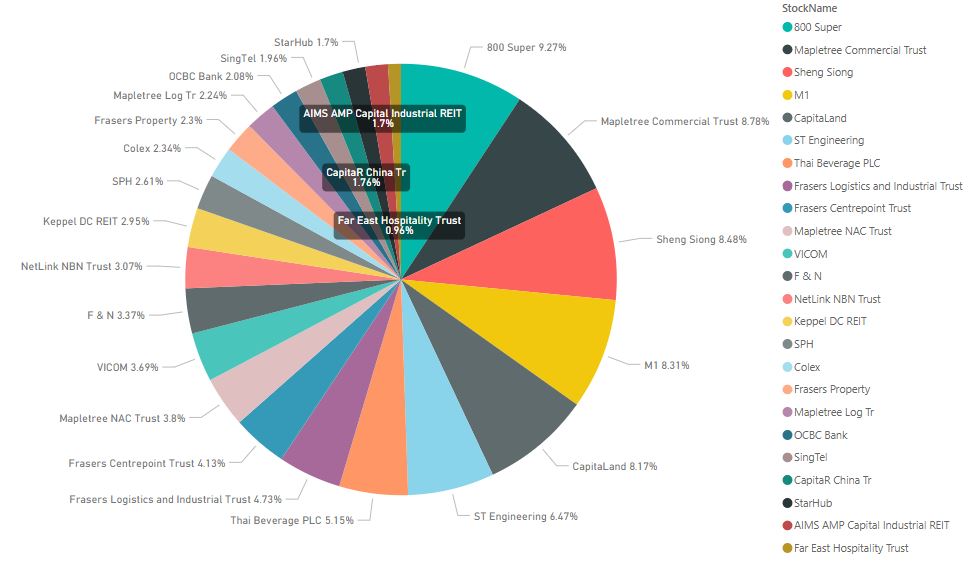

September 2018 Portfolio Updates

Stock Allocation Change Log Added Frasers Property Limited Overall, I think the month of September offered a sigh of relief as the fear of EM contagion and trade wars have subsided towards the end of the month. The US market reached all-time high and the Singapore market has rebounded back. It eve…

- Get link

- Other Apps

Have you truly reached FIRE?

When I first came across the term FIRE (Financial Independence, Retire Early), my first thought is that it is just a 'hipster' term to describe people achieving financial independence. FIRE seems to be more popular in the western culture and among the younger people. The term financial ind…

- Get link

- Other Apps

Singapore Savings Bonds October 2018

For those who are interested in 'timing' the rates before subscribing, you would have read that the US central bank is looking at 2 more interest rate hikes by the end of the year as US economy continues to expand at a faster pace. The hikes will result in the short-term rates to rise. The…

- Get link

- Other Apps