Does Temasek manages our CPF? Temasek Overview 2018 Key Takeaway

Simply NO. Our CPF is used to purchase Special Singapore Government Securities (SSGS) issued by the Singapore Government. The proceeds are pooled together with proceeds from other sources and then invested via MAS and GIC. GIC is a fund manager, and not an owner of the assets. Source: MAS

Temasek, on the other hand, is not a fund manager. It fully owns their investment assets. The Minister for Finance (body corporate, not a person) is the sole shareholder for Temasek and may

inject fresh capital or assets into Temasek. Source: Temasek Overview 2018

I may be wrong but how I would interpret that is Temasek is like a fully independent subsidiary whose parent company is 'Minister for Finance' corporation.

My Other Key Takeaways

- S$9b dividend from S$308b portfolio value which is approximately 3% yield.

- This may seem a little low but given the diversification into lower risk assets and growth sector, 3% is a reasonable dividend yield which is comparable to the STI.

- Investment in China (26%) is double that of US (13%).

- My view is that the long-term domestic growth in China will remain moderately strong after taking into account the US-China trade war. My main exposures to China market are in China Index ETF, CapitaLand, CapitaR China Trust, Mapletree NAC Trust and Mapletree Logistic Trust.

- Singtel is the largest single name concentration at 9% of Temasek's portfolio.

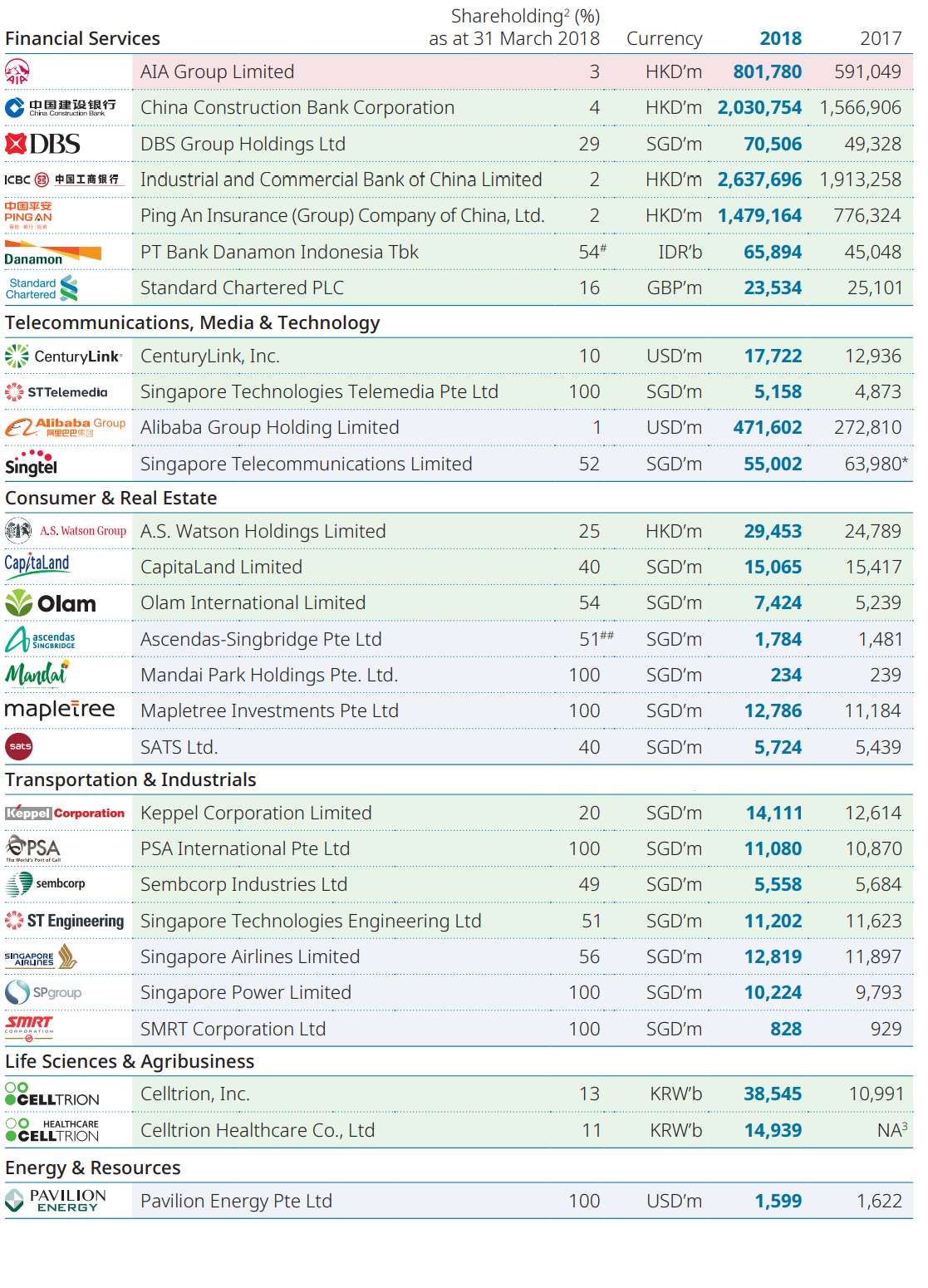

- Major investment portfolio composition

- My holdings are in Singtel, CapitaLand, Mapletree and ST Engineering.

|

| Source: Temasek Overview 2018 |

Hahaha, names are merely semantics. What's important is the behavior & source of funds / assets. From its actions, it is clear that Temasek is a sovereign asset / wealth manager. Its in the business of maximizing returns on assets. Its not in the business of providing banking services, trade financing, construction, city planning, sewerage systems, power grids, 4G or 5G networks, flying passengers, etc etc. Temasek's assets are in these businesses, but Temasek is only interested whether they are maximizing profits. It mainly leaves the various management teams to run their companies.

ReplyDeleteExcess taxpayer funds & govt revenue are channeled regularly into Temasek from MOF.

The problem is that Temasek's (and also GIC's) performance in the last 10 to 20 years has been mediocre --- either just matching a diversified global stock ETF or even underperformed.

The fact that a very expensive & very active investing-style team of analysts, strategists, economists & fund managers cannot *substantially* beat a passive global index approach is what gets many people pissed off.