November 2018 Portfolio Updates

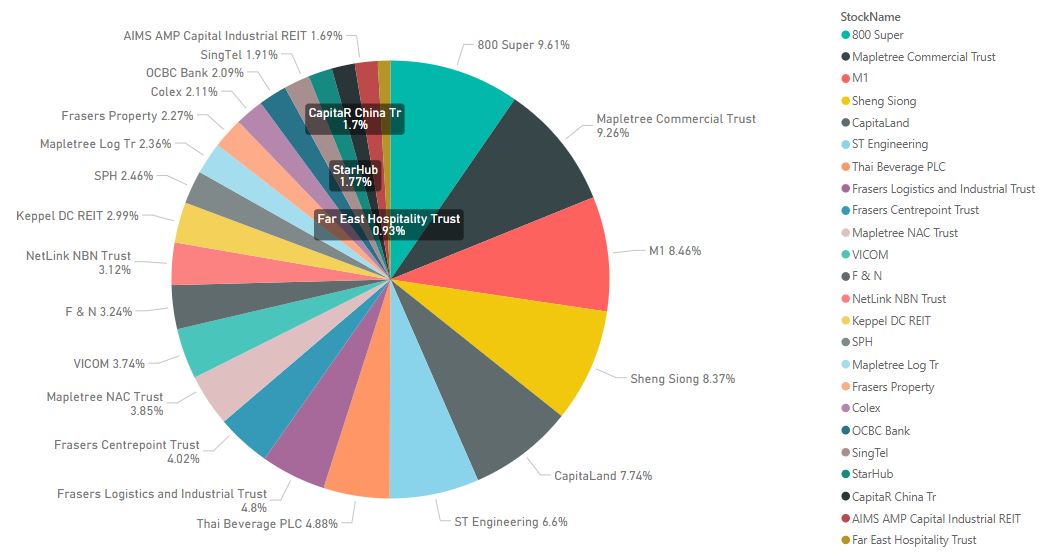

Stock Allocation

There was no stock transaction for the month of November 2018 yet again. November was a much better month as compared to the month of October. The Fed chairman made a comment that interest rate is close to neutral, suggesting that the rising rate could be slower and smaller over next year. This gave the market a boost resulting in the US markets to soar after the comment was made. STI has also rebounded but it was more tapered as concerns over trade war still linger. People will be watching the G20 summit closely to see if there will be any new development between US and China. There is no rush to enter or exit the market and patience is key. I will just continue to count my dividend while waiting.

Portfolio Allocation

Change Log- Redeemed Nov 2018 Singapore Savings Bond

- Added Dec 2018 Singapore Savings Bond

This month SSB was oversubscribed as both the short and long term average interest rates were higher as compared to most of the previous issues. The allocation was at the higher end and most people got what they applied for. I applied for it and was fully allocated. At the same time, I also redeemed the previous month issue of lower interest rate.

Cash holding remains on the high side since I did not find any opportunity to enter the market.

Comments

Post a Comment