April 2019 Portfolio Returns

|

| As of 30th April 2019 |

Since Inception (Including Dividends)

Total Portfolio Unrealized Gain/ Loss: $45,584.08

Total Portfolio Realized Gain/ Loss: $69,978.90

XIRR: 6.52%

Portfolio returns (realized and unrealized) reached an all-time high in April overtaking the high in last January 2018. Sadly, unrealized gains are fleeting and the market has since fallen due to the fear of trade war between US and China.

US has already increased the tariffs on over $200 billions worth of China imports but the market did not fell as much as I have expected. In fact, the SSE was up 3% on Friday after the implementation of tariffs. The market is not even near the low last December so I have not made any transactions yet. I will wait for the retaliation measures from China before deciding whether to enter the market or not.

Beside news on the trade war, the news that Best World was suspended also caught my attention. They were allegedly running a MLM scheme and sales figures could be inflated as transactions were not conducted at arm's length. The focus fell again on SGX RegCo and the auditors. It is perplexing how a company like this can be listed on SGX and passed all the audits. I am not vested.

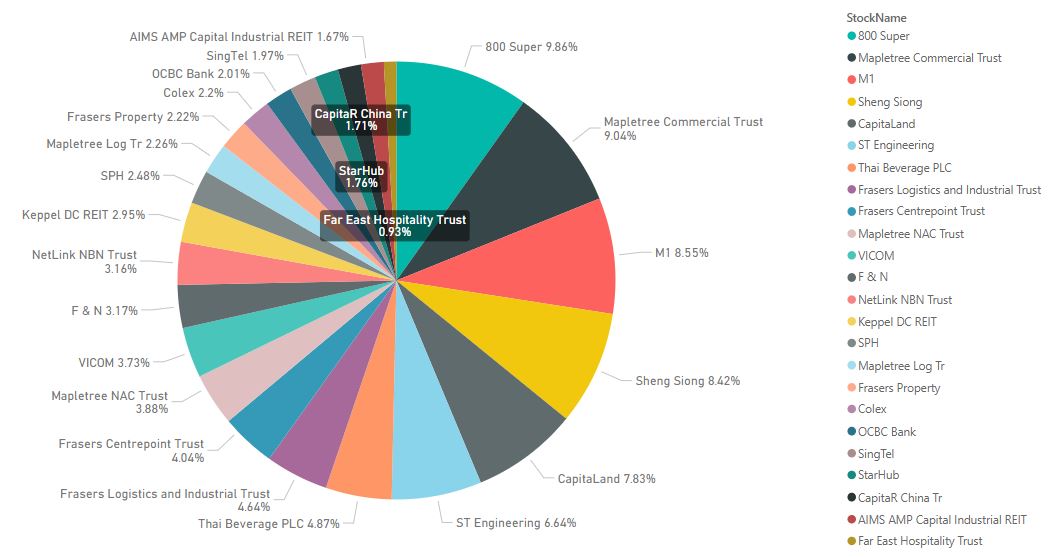

The only good news this week is that there is a general offer for 800 Super at $0.90. The offered price is about 10% premium to the last closing price before trading halt. 800 Super is one of my top 5 holdings and I will be accepting the offer. It is an opportunity to exit and locked in the profits. This will mean a huge outflow of fund from my portfolio if the deal goes through, and I will have to more aggressive in reinvesting the money.

|

| Portfolio Value (excluding Cash and SSBs) |

InvestingNote Profile: @SingularityTruth

Facebook Page: @SingularityTruth

Facebook Page: @SingularityTruth

Comments

Post a Comment