2018 Year-End Portfolio Allocation Review

Stock Allocation

There was no stock transaction for the month of December 2018. Next capital injection should be around Feb 2019.

There is a possibility that US and China may reach an agreement earlier than Mar as Trump recently tweeted that the negotiations are making good progress. This would be a good catalyst for the market to rally in the short term if a agreement could be reached. STI is hovering around 3000 points and has not breached the 3000 psychological barrier by end 2018, so we are still not in full panic mode yet. Not sure how long this would last though.

Summary of Transactions in 2018

FEB:

There is a possibility that US and China may reach an agreement earlier than Mar as Trump recently tweeted that the negotiations are making good progress. This would be a good catalyst for the market to rally in the short term if a agreement could be reached. STI is hovering around 3000 points and has not breached the 3000 psychological barrier by end 2018, so we are still not in full panic mode yet. Not sure how long this would last though.

Summary of Transactions in 2018

FEB:

- BOUGHT CAPITALAND

- BOUGHT F&N

- BOUGHT FRASERS L&I

- BOUGHT MNACT

- RIGHTS ISSUE FRASERS L&I

- BOUGHT MAPLETREE LOG

- BOUGHT ASTREA IV4.35%B280614

- BOUGHT CAPITALR CHINA TRU

- BOUGHT OCBC BANK

- BOUGHT ST ENG

- BOUGHT NIKKOAM SGD IGBOND ETF

- BOUGHT FRASERS PROPERTY

- BOUGHT TEMASEK 2.7% 231025XB

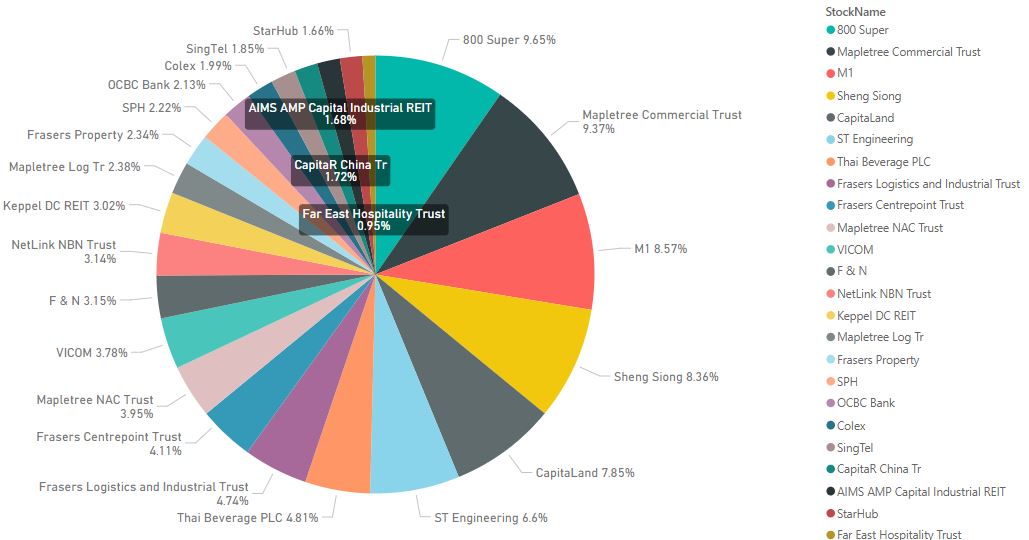

Portfolio Allocation

Change Log- Added Jan 2018 Singapore Savings Bond

This month SSB was again oversubscribed as the 1-year

average interest rate exceeded 2% for the first time. There is an increasing demand for SSBs due to the raising interest rate environment and volatile market conditions. Therefore, the allocation to individual could get smaller and smaller. Allocation to SSB has increased to almost 13% of my total portfolio. As a result, equity allocation has shrank to just around 55%. This is why I planned for a capital injection in early 2019.

REIT remains the largest sector in my portfolio. This is in-line with the objective of creating an income-focused portfolio. No rebalancing needed.

Comments

Post a Comment