February 2019 Portfolio Allocation Update

Stock Allocation

Change Log

- Added CapitaR China Tr

- Acceptance of M1 VGO

The deal for M1 has finally gone through and I am happy with outcome. With more than 90% control, M1 will be taken private and delisted. I am now left with a small portion of Singtel and Starhub which both of them are not doing very well at the moment. I also took the opportunity to accumulate more CapitaR China Tr after it went Ex-Date in Feb.

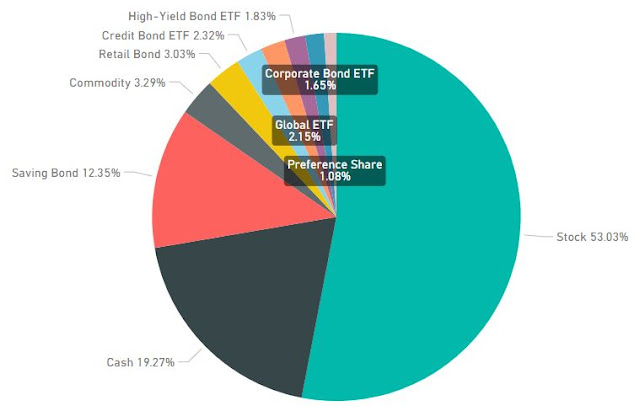

Portfolio Allocation

The payout received for M1 resulted in the increase for Cash allocation. I will need to put them back into the market as early as possible but if there are no opportunities, they will be going into Singapore Savings Bond temporarily.

Sector Allocation

With the exit of M1, Telecommunication Services sector has reduced to just 7% and REIT has increased to over 28%. The increase in proportion for REIT was due to better performance and capital injection. The sector allocation does not look balance and seems like there is overexposure to the REIT sector. With that in mind, I probably will have to do capital injections into other areas moving forward.

Comments

Post a Comment