Astrea V Class A-1 PE Bond

Astrea V Class A-1 PE Bond Summary

- S$180 millions offered to retail investors

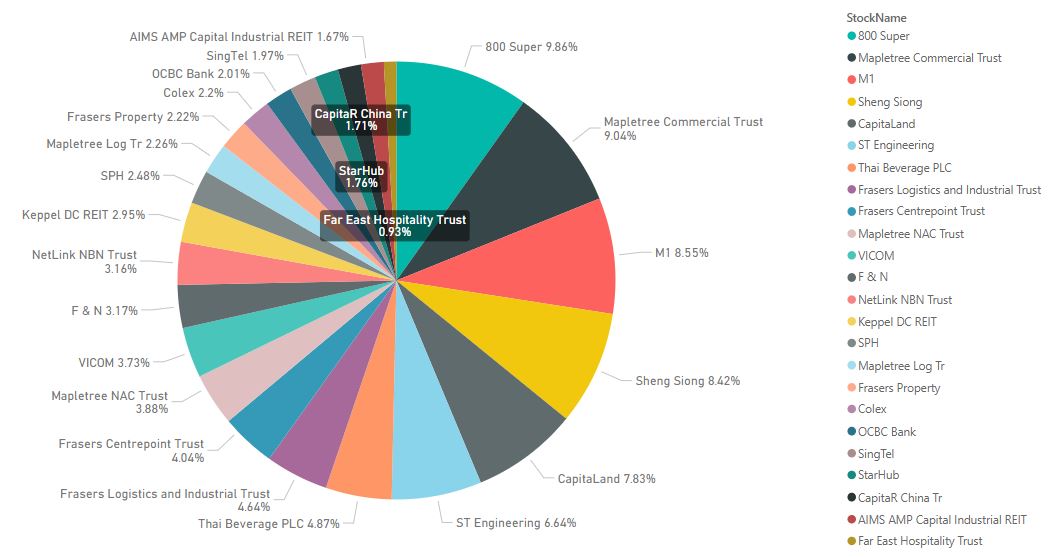

- 38 PE funds consisting of 382 companies

- 3.85% per annual (semi-annual interest payment)

- Mandatory Call date 20 June 2024 (5 Years)

- Maturity 20 June 2029 (10 Years)

- Closing date: 18 June 2019 12:00 NOON

- Minimum application of $2,000 in multiples of $1,000

- Link to Prospectus

The Astrea V PE Bond is the most talked about investment product this month. I have already planned to apply for it as mentioned in my previous few post, and I did applied for Astrea IV last year. Without any doubt, I will be applying for Astrea V again. So why am I buying?

Firstly, the PE bond is not backed by Temasek Holdings. You probably have heard this many times but this is not a reason for me to not to buy. I do not only purchase investment product which are backed by Temasek. In fact, the only product held by me which is guarantee by Temasek is the 5-Year T2023-S$ Temasek Bond. Everything else are not backed by Temasek and I still purchase them. There are certain risks associated with every product which I hold, and risk has to be managed by sizing the purchase.

Firstly, the PE bond is not backed by Temasek Holdings. You probably have heard this many times but this is not a reason for me to not to buy. I do not only purchase investment product which are backed by Temasek. In fact, the only product held by me which is guarantee by Temasek is the 5-Year T2023-S$ Temasek Bond. Everything else are not backed by Temasek and I still purchase them. There are certain risks associated with every product which I hold, and risk has to be managed by sizing the purchase.

For Astrea V, I do not have to worry much about sizing as it will be hard to get large allocation due to the popular demand. This time round, they have even provide the allocation plan.

Based on my previous tracked records for IPOs, I will be applying for less than $50,000 as I do not want to be subjected to balloting. But in order to get the highest allocation possible without balloting, I have no choice but to apply for $49,000. Using the previous allocation result as an estimate, I am expecting that I will be getting less than $5,000 if I applied for $49,000. $5,000 is something which I can afford to lose so that's my game plan for applying for Astrea V.

|

| Astrea IV Allocation Result |

Next, the coupon rate of 3.85% is acceptable to me. Comparing the coupon rate to a dividend yield of 8% penny stocks, 4% REITs, or 2% Singapore Savings Bonds are meaningless as each product have different risk and time frame. The simplest strategy is to diversify so that you do not end up at the extreme ends having 100% high-yield equities or 100% risk-free SSBs. Which is why from the portfolio management perspective, adding Astrea V provides diversification to my portfolio (more than 50% in equities) is acceptable. Adding 1-2% of higher risk PE bond into my portfolio will not wipe out my portfolio even if Astrea V is to default and I get back nothing.

Astrea V is the only second available private equity investment product which is available to retail investors, and the first being Astrea IV. The are no other products out there in the market for retail investors if they want to be vested in private equities. I see it as an opportunity for asset class diversification since tradition portfolios are only focused on bonds and equities.

Eventually, whether you decide to purchase or not boils down to whether you are comfortable with the risk/reward ratio of the product. There is no silver bullet in investing.

Astrea V is the only second available private equity investment product which is available to retail investors, and the first being Astrea IV. The are no other products out there in the market for retail investors if they want to be vested in private equities. I see it as an opportunity for asset class diversification since tradition portfolios are only focused on bonds and equities.

Eventually, whether you decide to purchase or not boils down to whether you are comfortable with the risk/reward ratio of the product. There is no silver bullet in investing.

InvestingNote Profile: @SingularityTruth

Facebook Page: @SingularityTruth

Comments

Post a Comment