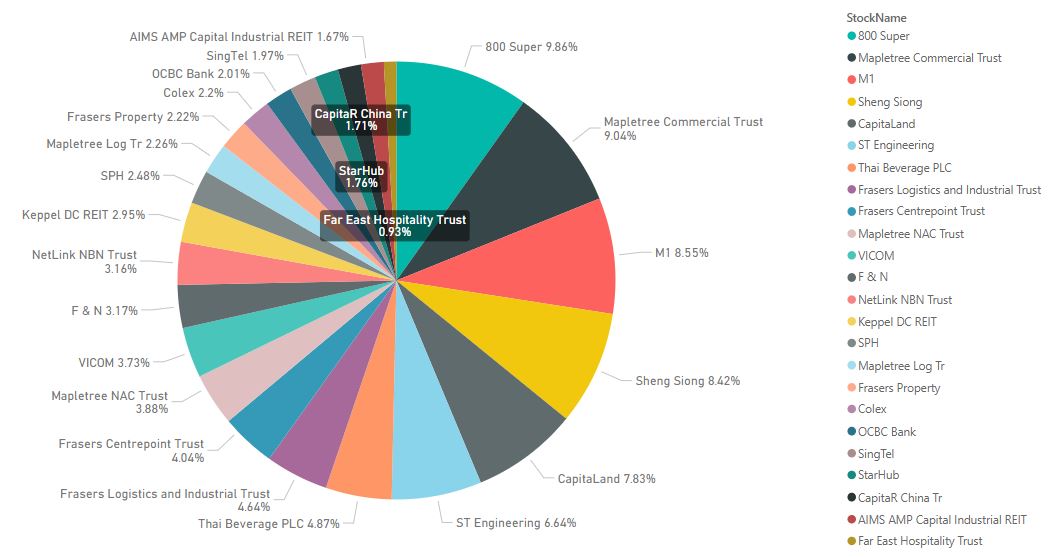

Portfolio Allocation (June 2019)

Stock Allocation

Change Log

- Accepted FRASERS CENTREPOINT TR NRO with excess

- Bought ASTREAVB290620

After a month of falling in May, STI staged a strong rebound in June. Instead of selling in May and go away, I did my accumulation in May, and so far the results have been very positive. As the market is on the high side, I did not add any new purchases in June and just applied for FCT preferential offering and Astrea V as planned.

For FCT, I was allocated 1000 shares in excess excluding entitlement and rounding shares. The allocation was satisfactory although I applied for more than that. As for Astrea V, I applied the maximum amount of $49,000 to be in the guaranteed allocation bracket and was allocated $7,000. This is much more than what I had anticipated given the high demand. With the new allocation plan, 50% of the big buyers when home without getting anything due to balloting. Probably this resulted in higher allocation to the remaining applicants.

The G20 summit has started and the direction of the market will be set for the next month depending on whether there is any progress on the trade wars. I will wait till there is clearer direction on the market after the summit before deciding the game plan for July. I have added more Singapore Savings Bond for July since the cash will not be deployed in near term.

Comments

Post a Comment