Portfolio Performance (March 2020)

Portfolio Returns

|

| As of 31st March 2020 |

Since Inception (Including Dividends)

Total Portfolio Unrealized Gain: -$17,336.68

Total Portfolio Realized Gain: $105,567.26

XIRR: 4.14%

Total Portfolio Unrealized Gain: -$17,336.68

Total Portfolio Realized Gain: $105,567.26

XIRR: 4.14%

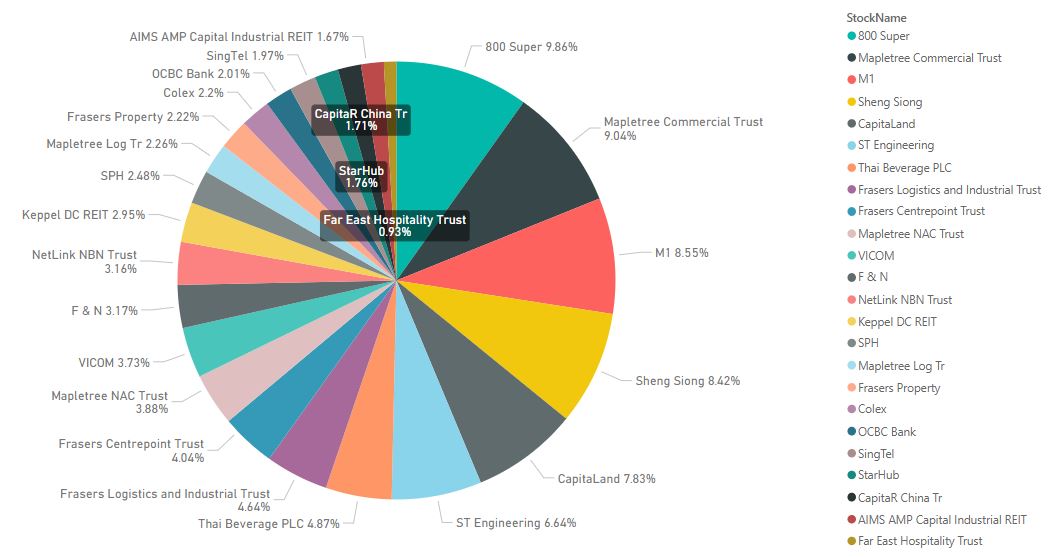

Portfolio Value

|

| Portfolio Value (excluding Cash and SSBs) |

As of 31 March 2020, my portfolio clocked the worst performance since inception with an unrealized lost of $17k. I was mentally prepared for such a day and this does not worry me. I did not go into panic selling mode as there is no urgent need to liquidate my portfolio for cash. Instead, I did 2 transactions to accumulate more equities. On hindsight, I should have bought more.

With all the money flooding the market from the stimulus packages, it seems like a V-shape recovery could be in sight. But on the ground, unemployment numbers are raising, businesses are still closed, and supply chains are disrupted. So the economy and stock market seems to be delinked at the moment. The next opportunity for accumulating equities will be after the announcement of the quarterly result where most companies performance will be impacted and will likely cut dividend distribution to conserve cash.

Without a vaccine out in the market, I believe the situation will not show any significant improvement. As for Singapore, we have yet to reach the peak and will continue to see exponential increase due to the spread in dorms. The CB will not be effective in curbing the outbreak in dorms. Things are about to turn ugly as a portion of these foreign workers will start to develop pneumonia in the following weeks. We will probably never know who will given the ventilator and those who did not as resources are limited. As for community spread, it is much more stable with sporadic outbreaks. Hopefully, community spread will start falling as we moved into the second week of CB.

There will still be opportunities to enter although it may not go as low as the prices in march again. Be prepare for the long haul and keep buying.

InvestingNote Profile: @SingularityTruth

Facebook Page: @SingularityTruth

Comments

Post a Comment