Satellite Portfolio Update

Holdings

- SPDR Barclays Capital High Yield Bnd, JNK

- iShares Preferred and Income Securities, PFF

- Vanguard Health Care, VHT

- Invesco QQQ, QQQ

- iShares China Large-Cap, FXI

The sell-offs in the US markets continue through this week. The

week started with multiple negative news such the possibility of Europe going

into lockdown again and the money laundering activities by banks. The US markets

rally have also probably overextended after reaching all-time highs, so a

correction was inevitable.

But what is interesting is that despite the Singapore market

been falling since the pandemic started, it followed the US market in this

sell-off. The Singapore market did not

follow the US market when it rallied, but when the US market sell-offs, it

followed. At this rate, reaching the March lows may not be too far-fetched for the

STI.

The sell-offs have also resulted in the strengthening of the

US Dollar which caused the dropped in gold price. Naturally, my Satellite

portfolio is not doing well, but the unrealized lost currently is still

negligible since the portfolio size is small. I do not have the intention to

sell and is still looking to hold with a long-term outlook.

I have also added a new constituent to my Satellite

portfolio which is iShares China Large-Cap ETF. This is supposed to be the

replacement for one of my ex-holdings, Xtrackers FTSE China 50, which was

delisted from SGX recently. Sadly after I bought, the news of China Evergrande facing liquidity crisis hits. The fall of

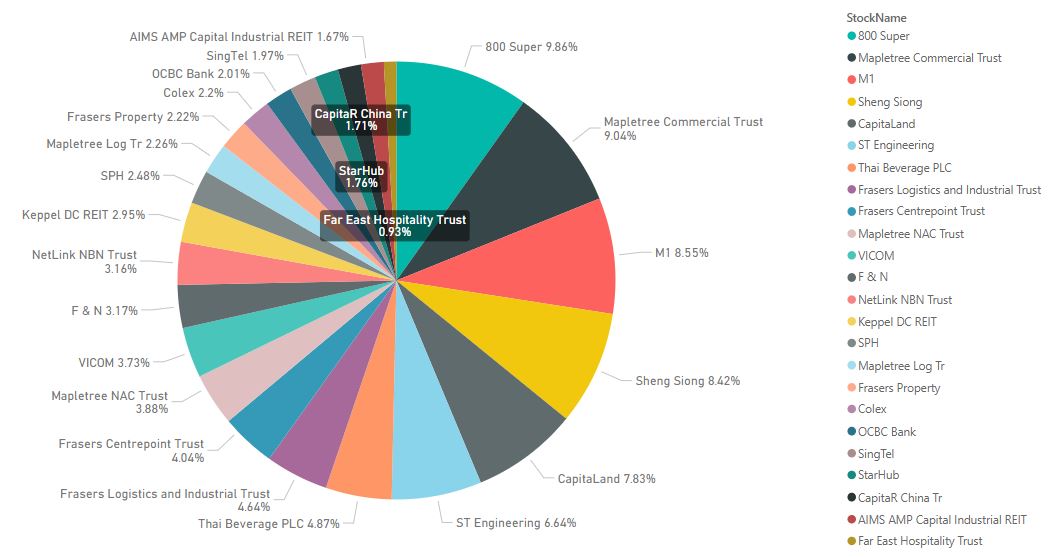

I think I will start doing some accumulation for my Core

portfolio as every pull-back is an opportunity to add. Nobody is certain how

low this time it will go, so never go all in at once. I will pace my purchases

for the long winter ahead. If we made it through the March winter, we will made

it through this winter again.

Comments

Post a Comment