October 2018 Portfolio Updates

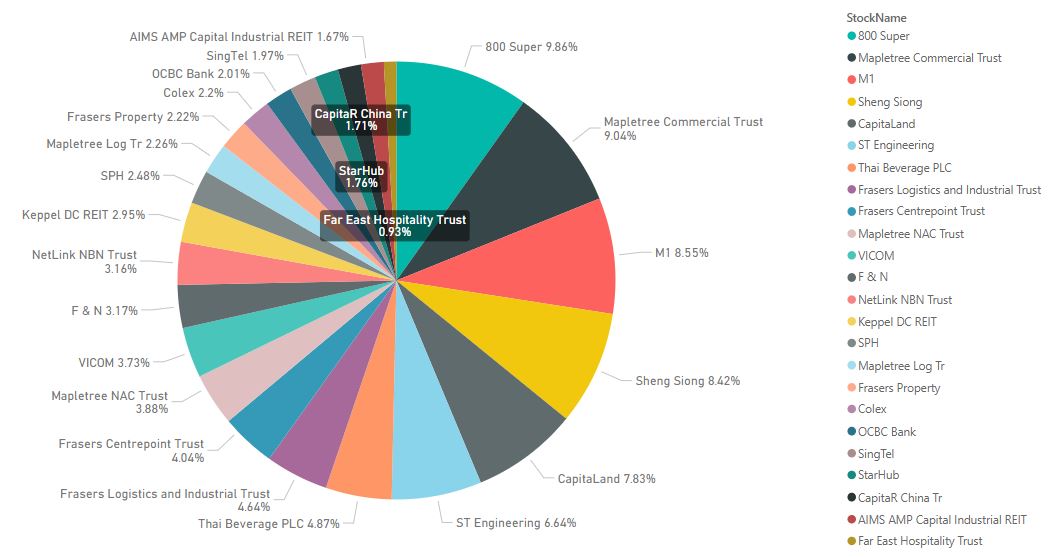

Stock Allocation

There was no stock transaction done for the month of October 2018. This is the month of Red October where STI has fallen below the support of 3000 points. But fortunately on the last day of the month, the market show signs of rebounding and managed to close slightly above it. Headlines are still revolving around increasing interest rates and trade wars causing the depressed market conditions. On the social media front, bloggers are discussing whether timing the market or time in the market would be a better strategy in the current environment. There are some who have already exited the market with 100% in cash and some who have already started to deploy their war chest.

For me, I am towards the camp where time in the market would be a better strategy. The challenge of timing the market is almost impossible for me as I have to be right twice, when to exit the market and when to re-enter the market. The fees required to liquidate my portfolio and re-entering at a later date will not be cheap. My preferred strategy has been trying to construct an 'all-weather' portfolio through diversification across different asset classes. I currently do not have the urge to enter the market as the increasing interest rates for Singapore Saving Bonds are becoming more attractive for something which are risk-free. Now it feels like Red October has passed and it's time for a Great November!

Portfolio Allocation

Change Log

- Added Temasek Bond

- Added Singapore Savings Bond

- Maturity of Perennial Retail Bond

As mentioned in my previous posts, I have applied for both the Temasek Bond and SSB this month. The Temasek Bond came just in time to replace the Perennial retail bond which has matured. As for SSBs, which are acting as my pseudo-savings account, the amount I applied for was fully allocated. Overall portfolio allocation looks like I am still overweight on cash and I will continue to deploy them into SSBs for the following few months.

Comments

Post a Comment