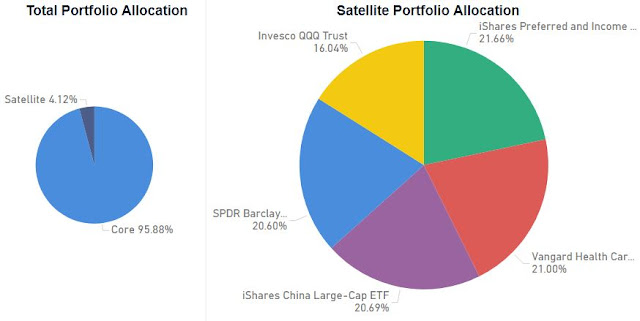

Satellite Portfolio and Weekly Updates

Holdings

- SPDR Barclays Capital High Yield Bnd ETF, JNK

- iShares Preferred and Income Securities ETF, PFF

- Vanguard Health Care ETF, VHT

- Invesco QQQ Trust, QQQ

- iShares China Large-Cap ETF, FXI

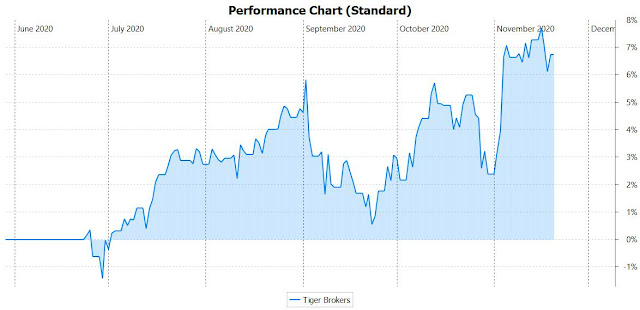

Despite the sector rotation in the US markets, the NASDAQ100 ETF was holding up quite well and the outflow of funds did not result in heavy corrections. Rather, it seems that large amount funds are flowing into Dow Jones and S&P500 counters. My exposure to the tech sector was also not significant at around 16% of my satellite portfolio, which is probably why it did not affect my performance much.

The STI continues to rally for the week and manages to closed above 2800 points. Even dead stock like SPH manages to gain 20% in a single day. As mentioned in my previous post, I would probably end my accumulation phase for this year if there are no major corrections moving ahead. What is left for me to do is just to decide on the 2 upcoming preferential offering by Ascendas REIT and CapitaRetail China Trust, and to top-up my SRS.

InvestingNote Profile: @SingularityTruth

Facebook Page: @SingularityTruth

Comments

Post a Comment