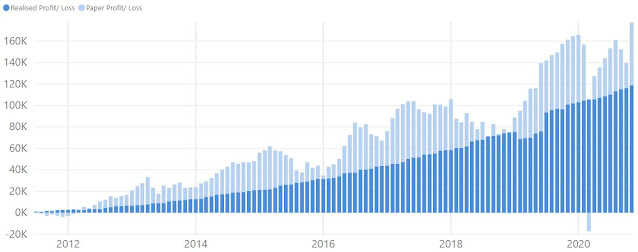

Portfolio P/L Updates (November 2020)

Total Portfolio P/L

|

| As of 30th Nov 2020 |

Since Inception

Total Portfolio Unrealized Gain: $58.54K

Total Portfolio Unrealized Gain: $58.54K

Total Portfolio Realized Gain (Including Dividends): $118.72K

XIRR: 6.86%

Portfolio Market Value

| |

|

The November rally resulted in my total gain comprising of realized and unrealized to reach all-time high. Total portfolio value is also at all-time high including contributions from capital injections. My purchases since March till now has paid off after the market rebounded, with the US election concluding and the news of vaccine made available to the public. On hindsight, if I would have poured all the money in March, it would have made more gains. But psychologically, I felt more comfortable buying at regular intervals and I was making purchases almost on a monthly basis.

In fact, I felt that as long as you are invested this year, you would probably have made some money. US markets are higher than pre-COVID levels, STI has rebounded strongly but not yet at pre-COVID levels, commodities like gold and silver are higher, and Bitcoin is at all-time high. Looks like the low interest rate environment and government stimulus are driving everything up. Liquidity is flooding the market and people are avoiding holding cash.

The trend is expected to continue in the near-term as US is looking at another round stimulus. Some profit taking may occurs once the stimulus is confirmed, but I think the uptrend will still be intact for the rest of the year. So far, I am sitting on the sideline for the month since almost everything is priced on the high side.

InvestingNote Profile: @SingularityTruth

Facebook Page: @SingularityTruth

Comments

Post a Comment