Satellite Portfolio Updates

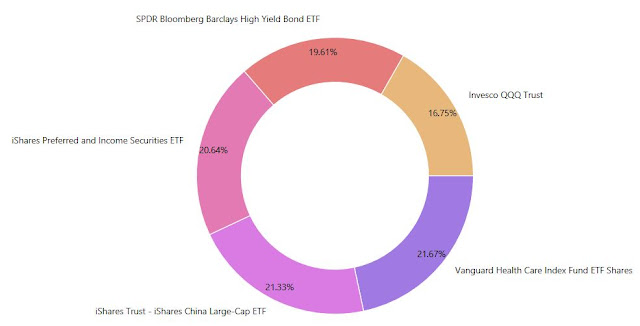

Satellite Portfolio Allocation

Holdings

- SPDR Barclays Capital High Yield Bnd ETF, JNK

- iShares Preferred and Income Securities ETF, PFF

- Vanguard Health Care ETF, VHT

- Invesco QQQ Trust, QQQ

- iShares China Large-Cap ETF, FXI

The performance of my satellite portfolio greatly outperforms my core portfolio at the moment. The satellite portfolio focuses more on growth whereas the core portfolio focuses on income. One thing with a growth portfolio is that all the gains are unrealized so there is always the worry that the market direction might change causing all the gains to disappear. As for income portfolio, the dividends received are all realized cash in my bank.

I have not made any purchase for the year yet, still waiting for a correction or some retracement.

InvestingNote Profile: @SingularityTruth

Facebook Page: @SingularityTruth

Comments

Post a Comment