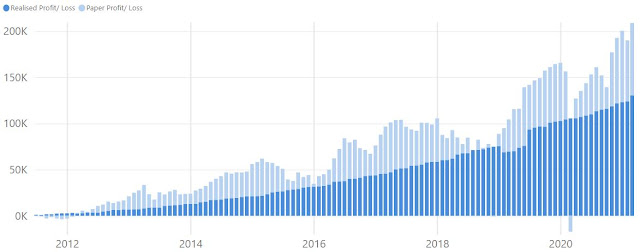

Portfolio Performance Review (Mar 2021) - ATH

Total Portfolio P/L

| |

|

Since Inception

Total Portfolio Unrealized Gain: $78.58K

Total Portfolio Unrealized Gain: $78.58K

Total Portfolio Realized Gain (Including Dividends): $130.44K

XIRR: 7.41%

Portfolio Market Value

|

| Portfolio Market Value (excluding Cash and SSBs) |

Portfolio performance reached all-time high in March again. The main contributions are from the gains locked in after realizing the gains from CapitaLand. STI also rebounded steeply in March to above 3000 points but has been consolidating since April. STI managed to close above 3200 points again this week but it remains to be seen if it can hold the line.

There are other markets, the US and cryptocurrency, which are generating more buzz and attracting all the attention from the local market. Indices are close to all time highs and cryptos are rocketing. More and more people are starting to invest with the entry of low-cost brokerages such as Tiger Brokers and Futu MooMoo. These brokerages are giving out very attractive gifts to attract new investors. Tiger is giving 1 free share of Disney worth USD$185+/-, and MooMoo is give 1 free share of Apple worth USD$134+/-. That is like more than S$400 worth of money if you signed-up for both and sell the stock immediately. You can also choose to hold the stock if you want to. I am still holding on to the 1 share of Apple stock which has gained ~10% since I signed up.

I have done quite a few transactions for my US portfolio and still have multiple pending orders. The US market is quite bullish and it is quite hard to enter during this period. Waiting for another retracement to accumulate.

InvestingNote Profile: @SingularityTruth

Facebook Page: @SingularityTruth

Comments

Post a Comment