Portfolio Performance (June 2019)

Portfolio Return

|

| As of 28th June 2019 |

Since Inception (Including Dividends)

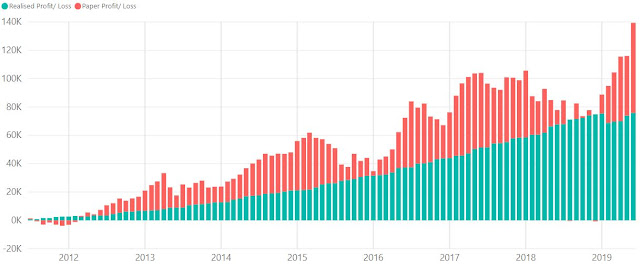

Total Portfolio Unrealized Gain/ Loss: $63,577.37

Total Portfolio Realized Gain/ Loss: $75,824.91

XIRR: 7.67%

Portfolio Value

|

| Portfolio Value (excluding Cash and SSBs) |

Unrealized gain spiked up in June due to the strong rally in REITs, resulting in total gains to reach an all-time high. The US markets have also reached an all-time high as markets are currently driven higher by the news that interest rates will be cut in end-July. This is a little counter-intuitive as rates cut is a sign of weaker economy. A weaker economy which requires a rates cut to stimulate is causing the stock market to go higher?

In Singapore, there were some profit taking in the REITs sector. The latest result for Q2 GDP wasn't so positive and raises the possibility of technical recession. Both GIC and Temasek Holdings have also recently announced their results and both companies are adopting a more defensive posture in their portfolio. I have not done any transaction this month and have no intention to take profit as my priority is still income over capital appreciation. I will have to be more cautious with my capital injection moving forward and adopt a more defensive portfolio allocation as well.

InvestingNote Profile: @SingularityTruth

Facebook Page: @SingularityTruth

Comments

Post a Comment