Dividend Collected (June 2019)

|

| Dividend by Month (Since inception) |

|

| Dividend Collected 2019 |

Dividend collected for the month of June 2019: $1,964.41

- NETLINK NBN TR

- THAIBEV

- F & N

- FRASERS PROPERTY

- FAR EAST HTRUST

- MAPLETREE LOG TR

- ASTREAIVB280614

- OCBC BANK

- FRASERS L&I TR

|

| Dividend Collected to Date |

Dividend (YTD): $9,094.02

Average Monthly Dividend (YTD): $1,515.67

Total Dividend Collected to Date: $83,949.91

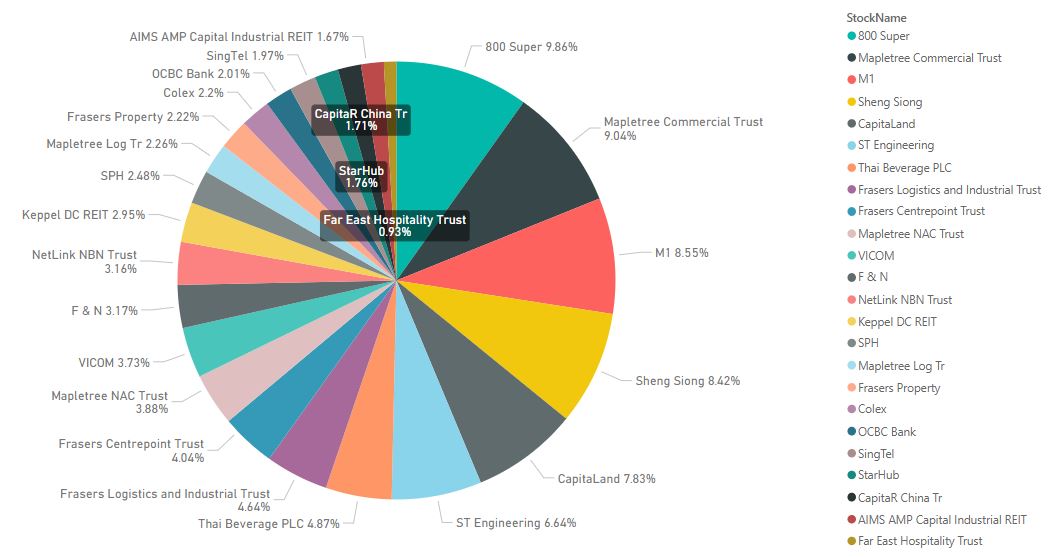

June was another bumper month for dividend collection, especially from REITs. The dividend collected in June this year was the highest compared to previous years. Based on previous records, July will be a low month with little dividends coming in.

Funds continue to flow into the REITs sector and this could be the strongest rally for REITs since I started investing. Traditionally, REITs were seen more of a regular income generating, due the dividend distributions, and stable asset class with little fluctuation. But it seems now that substantial growth and capital appreciation for REITs are not uncommon. So it's like getting the best of both worlds by investing in REITs.

MAS is currently looking at raising the gearing limit allowed by REITs from 45%. This could be a potential catalyst for REITs to expand further through M&A. I am thinking that perhaps I was too conservative in the past, keeping REITs to around 30% of my portfolio. In order to align with MAS goal to make Singapore into a global hub for REITs, I would be adjusting my portfolio to allow for a larger allocation to REITs over time, probably to around 40% of my portfolio.

InvestingNote Profile: @SingularityTruth

Facebook Page: @SingularityTruth

Is it a good time to get into REITs now?

ReplyDeletePersonally, I think that REITs from the CapitaLand, Mapletree and Frasers family are trading on the higher side. But what is high could go higher. It really depends on the price that you are comfortable with.

Delete