Dividend Collected (July 2019)

|

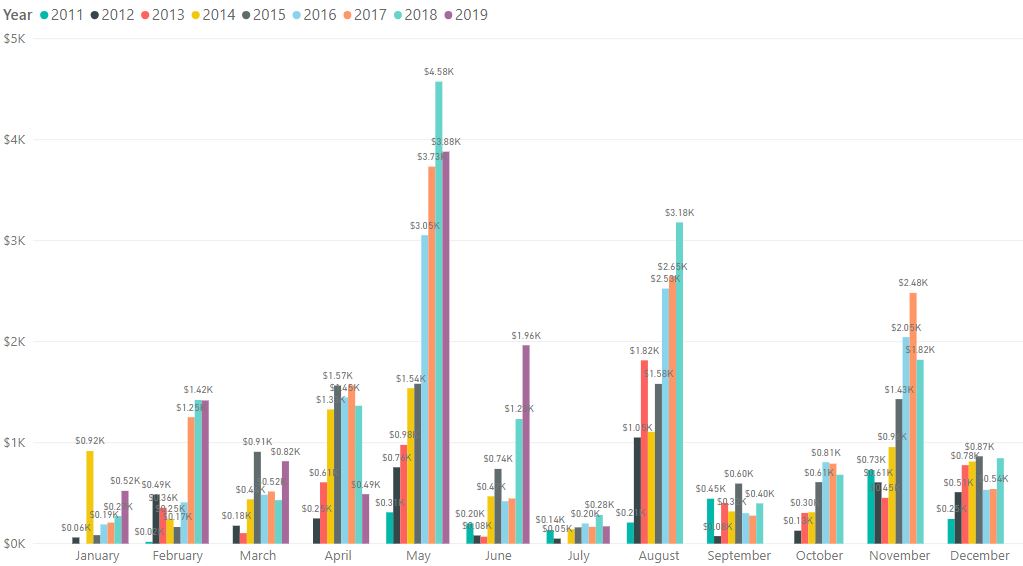

| Dividend by Month (Since inception) |

|

| Dividend Collected 2019 |

- FRASERS CPT TR

|

| Dividend Collected to Date |

Dividend (YTD): $9,265.83

Average Monthly Dividend (YTD): $1,323.69

Total Dividend Collected to Date: $84,121.72

Just a short update. As expected, July is a month with low dividend income, with Fraser CentrePoint Trust the only one received. STI has started to pullback and there should be opportunities to accumulate this month.

Just a short update. As expected, July is a month with low dividend income, with Fraser CentrePoint Trust the only one received. STI has started to pullback and there should be opportunities to accumulate this month.

InvestingNote Profile: @SingularityTruth

Facebook Page: @SingularityTruth

I came across your blog sometime ago and was surprised by the sheer coincidence that we both started tracking our dividend income in 2011.

ReplyDeleteThanks to you, I started using your "bridge" presentation format. This "bridge" format lets one sees the individual and cumulative results in a quicker and more pleasing way as opposed to the traditional bar charts with an overlay curve for the cumulative value.

I dont know how old you are but I started to track my passive income (dividends, rental, bonds and CPF interests) seriously only after I was past 50 yo. So if you are way younger than me, kudos to you! Time is on your side and time is one of the important factors to build wealth.

So how different is our passive incomes performance? At my age, I have urgency to build up my passive income and passive income sources as quickly as possible before I retire. From 2011, we started to deploy more and more of our savings into equities and bought an investment property for rental income.

Suffice to say, the passive income has been growing steadily over the years, and this year (from Jan to Jul 19) so far, we have collected $111,000. Last year it went over $170,000. We are hopeful that this year's passive income will cross over $180,000.

If you keep at it and reinvest your dividends, you will get there!

Oh yes, as we are now nearer and nearer to retirement, we have started to shift some of the dividends and rental income into our CPF accounts. The annual combined interest that we get from all our CPF accounts is quite substantial as well. The CPF can be a good pillar in your overall wealth build up strategy.

Thanks a lot for the sharing! I see that we are aligned with our investment strategy and approach, and hopefully for me to eventually reach your level of passive income. Cheers!

Delete