Closed Position in Mapletree NAC Trust and Portfolio Performance (October 2019)

Portfolio Returns

|

| As of 31st October 2019 |

Since Inception (Including Dividends)

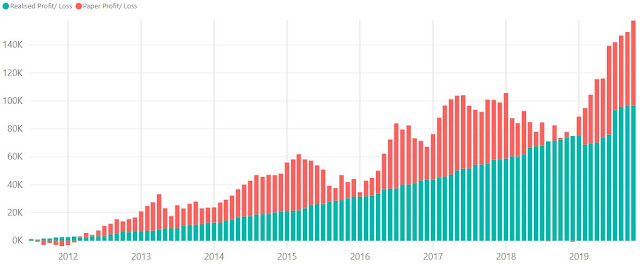

Total Portfolio Unrealized Gain: $60,858.02

Total Portfolio Realized Gain: $96,549.89

XIRR: 7.72%

Portfolio Value

|

| Portfolio Value (excluding Cash and SSBs) |

This week, I closed my position in Mapletree NAC Trust after reading that one of the malls under the REIT, Festival Walk, was targeted by the Hong Kong protester. The mall was extensively vandalized and damaged that it has to be closed for weeks. The protest in HK has stretched over 6 months but Festival Walk had not been targeted so far until an incident last Sunday.

The HK police force did an undercover operation last Sunday in the mall making arrest, and a large group of police went in later to carry out a dispersion operation. Multiple protesters were injured and arrested during the operation. The protesters put the blame on the mall and it was vandalized on the following Monday night.

The main reason that I sold all my holding in MNACT is that there is a possibility that the mall might be repeatedly targeted by the protester, even though the mall is closed. This is what had happened to shops which are targeted by protester.

Separately, the situation in Hong Kong not only did not calm down after 6 months, but in fact, it has escalated, and is getting more violent. The streets are less crowded now as the protest are extending throughout the day across multiple districts. This would reduce shopper traffic, and eventually the shops in the mall might just stop renewing their lease.

The last point is that Festival Walk contributes to 60% of MNACT income which in my opinion is quite significant. As there seems to be an impasse between the protester and government, I do not expect the situation to subside soon. Therefore, I decided to exit the position in MNACT until the situation in Hong Kong recovers.

InvestingNote Profile: @SingularityTruth

Facebook Page: @SingularityTruth

Comments

Post a Comment