Dividend Collected (May 2020)

Dividend Breakdown by Sector

| |

|

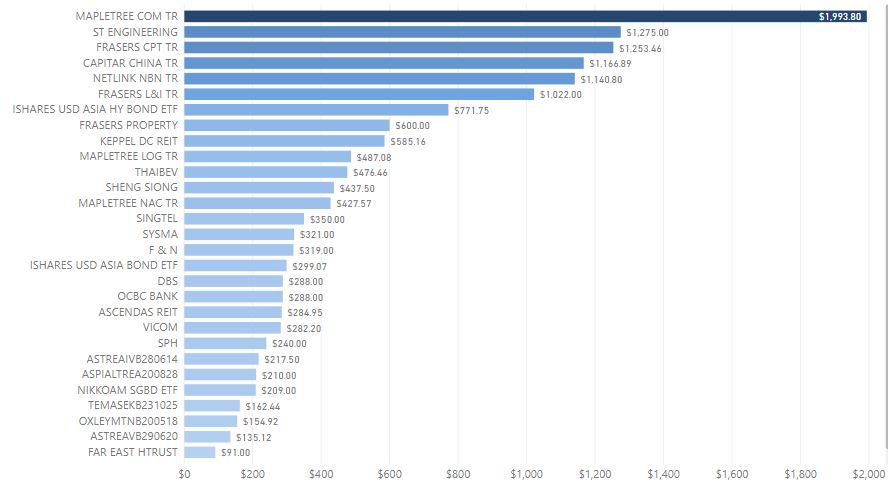

Top Dividend Contribution (Last 12 Months)

Dividend Collected to Date

Dividend Collected in 2020

Dividend by Month (Last 5 Years)

Dividend collected for the month of May 2020: $1.55K

- OXLEYMTNB200518

- SPH

- DBS

- FRASERS CPT TR

- MAPLETREE COM TR

- ST ENGINEERING

Dividend (YTD): $5.10K

Average Monthly Dividend (YTD): $1.02K

Total Dividend Collected to Date: $96.94K

An interesting realization is that both my capital appreciation and dividends are driven by the REITs sector. So REITs will remain my preferred target sector for accumulation.

We have seen a strong rally from the start of the month until mid-week when the market sentiments suddenly turned overnight. Heavy profit taking took place after the FOMC meeting suggesting that the interest rates will be maintained close to zero until 2022. I see this as a negative news although there is no change in direction. This could mean that the economy will be dovish for the next 2 years! This is similar to the assessment of our ministers where the economy will take a few years to recover.

Having said that, it does not give any indication on the direction of the market since the stock markets and economy correlation are now less obvious due to the stimulus packages. Most people think that the price and what is actually happening on the ground will eventually meet. My strategy does not change and will continue to accumulate regularly when there is a retracement.

On a separate news this week is the announcement of demerger between SembCorp Industries and SembCorp Marine. I am not vested in both stocks but was excited about the news. After the demerger, SembCorp Industries will come under my watchlist since it fits into my portfolio in terms of diversification, dividend and lowered beta. It is still a bit early now but I will keep a lookout until the demerger completes.

InvestingNote Profile: @SingularityTruth

Facebook Page: @SingularityTruth

Comments

Post a Comment