Dividend Collected (June 2020)

Dividend Collected to Date

Dividend Collected in 2020

Dividend by Month (Last 5 Years)

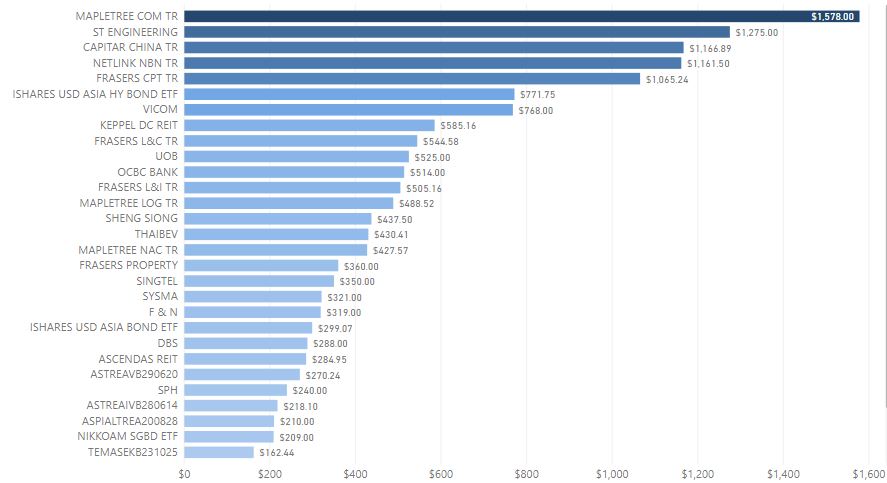

Top Dividend Contribution (Last 12 Months)

Dividend Breakdown by Sector

|

| *Does not include dividend from stocks which I am no longer holding |

Dividend collected for the month of June 2020: $3.21K

- NETLINK NBN TR

- MAPLETREE IND TR

- VICOM

- OCBC BANK

- MAPLETREE LOG TR

- STARHUB

- THAIBEV

- ASTREAIVB280614

- F & N

- ASTREAVB290620

- FRASERS L&C TR

- UOB

Dividend (YTD): $8.31K

Average Monthly Dividend (YTD): $1.39K

Total Dividend Collected to Date: $100.15K

June’s dividend was bountiful probably due to the postponement of AGM which resulted in the delay of distributions into June. With the addition of a satellite portfolio, I will be receiving dividends from these US ETFs monthly in the future as the distributions are done monthly.

The US, China markets, and Gold have raised sharply for the month due the abundance of liquidity from stimulus packages and low interest rate environment. As the price of asset rises, FOMO behavior became prevalent. The competition between low cost brokerages did not help either, and the low barrier of entry caused a flood of new investors into the market which pushed prices even higher.

Despite the pandemic which is still ongoing and showing no signs of easing, a bubble is seem to be forming. History has told us that all bubbles will burst eventually. It is just a question of when. Money can still be made when the bubble is inflating or after it burst, and it depends on how well investors can time the market. Of course this is a high risk, high reward approach where most people fell into the trap of buying high and selling low. The other way is to just ride through the waves which I am adopting, although having to miss out on the potential opportunities.

InvestingNote Profile: @SingularityTruth

Facebook Page: @SingularityTruth

Comments

Post a Comment