Satellite Portfolio Update and Withholding Tax

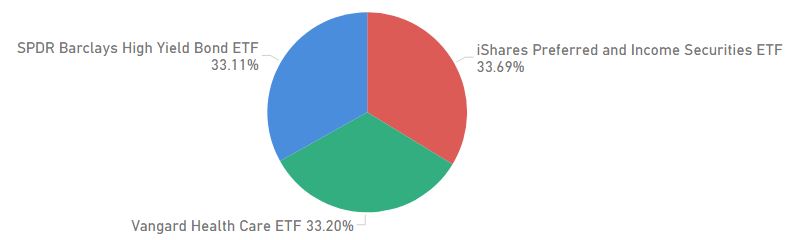

Holdings

- SPDR Barclays Capital High Yield Bnd ETF, JNK

- iShares Preferred and Income Securities ETF, PFF

- Vanguard Health Care ETF, VHT

Finally completed the setup of my satellite portfolio with the first 3 ETFs.

When I first conceived the idea of having a satellite portfolio, my plan was

to have 3 ETFs, equally weighted, focusing on fixed income products. Instead

of picking individual stock, I chose ETF so that the portfolio will be

diversified despite its small size. After some considerations, I noted that

withholding tax will eat into my returns over the long term, and so I will be

adjusting my portfolio to include both fixed income and growth ETFs in order

to avoid withholding tax as much as possible.

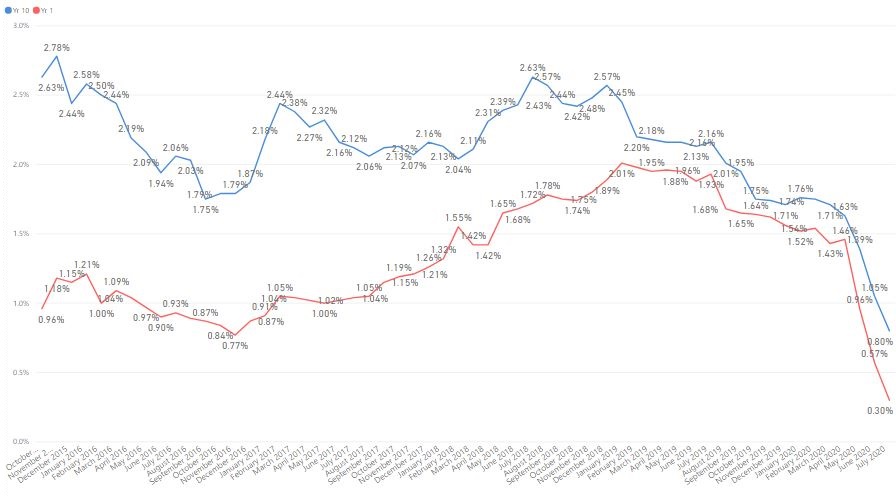

On the topic of withholding tax, most would know that US has a 30%

withholding tax on dividend income and the recommended way is to buy

Ireland-domiciled ETFs which would reduce withholding tax to 15%. The less

mentioned is the Qualified Interest Income (QII) for Non-Resident Alien

(NRA).

NRA shareholders may be exempted from all or a portion of the

withholding tax on distributions attributable to interest-related dividends

and short-term capital gain dividends received under the American Jobs

Creation Act of 2004. Investment company will publish online the list of

products and the amount of income which are exempted.

JNK and PFF are fixed income, and a portion of their incomes are applicable

for QII, while VHT will be for growth. Both JNK and PFF do monthly distribution,

and VHT does quarterly distribution. I received the fully distribution from

JNK in July and will continue to monitor in the following months. VHT will

be focusing on capital appreciation, with low distribution yield, and is

less impacted by withholding tax.

There are many similar ETFs listed in the US and it took me quite some time

to finalize the holdings. Some of the ETFs which I looked at were QQQ, HYG, IBB,

VUG, and XLV. There is a possibility that I will increase my satellite

portfolio size and number of holdings in the near future, depending on how

Tiger Brokers evolves.

Since my last mention of using Tiger Brokers to build

my satellite portfolio, it has improved by switching to DBS as its fund

custodian. SGD fund deposit now only took around 10 mins from 1+ hour in the

past. They are also changing their share custodian for SGX-listed products,

allegedly to DBS, but there is no confirmation yet.

This is my Tiger Brokers Referral link if you are interested.

Edit: Correction post can be found here.

Disclaimer: This post is not a recommendation to buy or sell any mentioned

products. This is not sponsored content.

Non of these ETFs are ireland based right ? Can u elaborate about your comment on "The less mentioned is the Qualified Interest Income (QII) for Non-Resident Alien (NRA). "

ReplyDeleteNone of the ETFs I owned are Ireland-domiciled. There are only a few listed on the London stock exchange so there are not much option.

DeleteThe alternative is to look at ETFs which qualified under QII which are usually bond ETFs. Both JNK and PFF are under QII. Everything else is probably subjected to 30% WHT.

Thanks for clarifying. Is there any thing you personally need to do to qualify for QII (e.g submit forms) or is it automatic on purchase ?

DeleteNothing, it will be handled by the brokerages.

DeleteNote that US dividends from Tiger Brokers are subjected to full 30% withholding tax. Correction post can be found at https://singularitytruth.blogspot.com/2020/08/correction-on-tiger-brokers-withholding.html

Delete