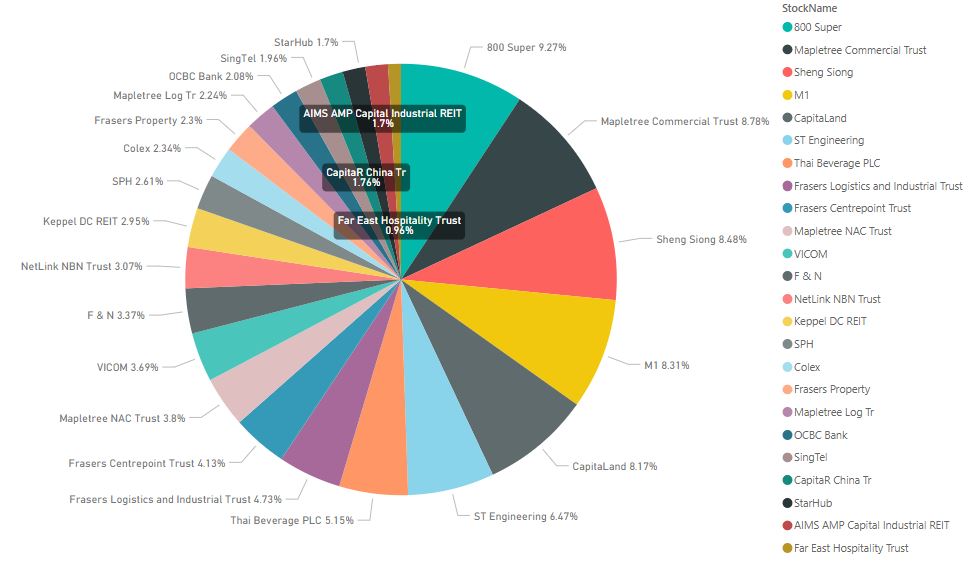

September 2018 Portfolio Updates

Stock Allocation

Change Log

- Added Frasers Property Limited

I am looking at the banking and property sector as mentioned in my previous post and decided to add Frasers Property to my portfolio this month. It seems to be a risky move given the recent cooling measures and rising interest rate environment, but I can't really time the market so I just went in. The following comparison table is for your own reference.

|

| Source: CGS-CIMB Research |

Portfolio Allocation

Sector Allocation

There is a new upcoming Phillip SING Income ETF which will be listed on 29 October 2018. The ETF is yield-focused and tracks the Morningstar® Singapore Yield Focus Index. I have no interest in adding it to my portfolio since the ETF consist of 100% equities listed on SGX which is similar to my portfolio. The following is a comparison between the sector allocation of the Index and my portfolio. It is good to see how the active fund mangers are constructing their portfolio, and if it suits your investment objectives, you can try to replicate it in your own portfolio.

The top 10 stocks in the Morningstar® Singapore Yield Focus Index consist of the following.

- Singapore Telecommunications Ltd

- DBS Group Holdings

- Overseas-Chinese Banking

- United Overseas Bank

- Singapore Exchange Ltd

- Singapore Technologies Engineering Ltd

- SATS Ltd

- Capitaland Commercial Trust

- Hong Kong Land Hldgs Ltd

- CapitaLand Mall Trust REIT

General Offer for M1

Keppel Corp and SPH have formed a joint ventured company, Konnectivity Pte Ltd, to attain 33.27% combined shares of M1. The company made a voluntary general offer price of $2.06 for each share of M1 not owned by them in order to gain majority control so that they can lead the restructuring of M1. Axiata, the next largest shareholder, mentioned that they are considering to reject the offer but it does not matter as Konnectivity requires only an addition 16.73% shares to hold more than 50% of M1 with majority control. In order to make a counter general offer, Axiata will first have to increase their holding to more than 30%. The scenario which investor should avoid is holding onto the shares and M1 gets delisted.If I accepted the offer, it will be a lost for me. The offered price is lower than the average price of my holding, but there is not much of an option for minority investor. It does not make sense to continue holding on to the stock as the Telco sector is over-saturated with upcoming TPG entry. M1 will be facing decreasing revenue with increasing competition, raising operation costs and cuts in dividends. The offer provides me an opportunity to exit with a smaller loss. Of course a counter offer by Axiata will even be better. Looks like I will have to start planning where to deploy the addition funds from the offer if the transaction does goes through.

Comments

Post a Comment