Posts

Investment Portfolio 2019: Rewind

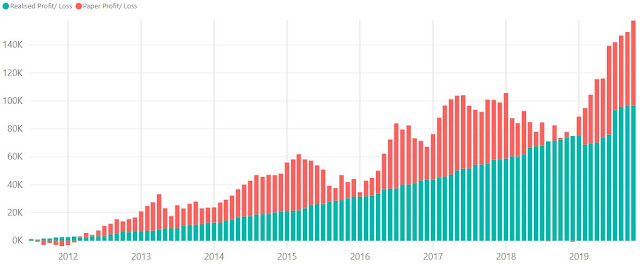

Rewind Time flies and we are coming to the end of 2019. I recalled in December 2018, things were not as rosy as compared to this year. The Fed raised interest rates and REITs had a 'correction'. My portfolio even went into unrealized lost territory. That's was when I blogged that I wil…

- Get link

- Other Apps

January 2020 Singapore Savings Bond

Application Closes: 9.00pm, 26 Dec 2019

Details on this month SSB can be found on SGS website.

InvestingNote Profile: @SingularityTruth Facebook Page: @SingularityTruth

- Get link

- Other Apps

Portfolio Performance (November 2019)

Portfolio ReturnsSince Inception (Including Dividends) Total Portfolio Unrealized Gain: $60,361.16 Total Portfolio Realized Gain: $100,871.59

XIRR: 7.75%

Portfolio Value

The cold weather is making me a bit lazy and I haven't been catching up with latest market news so this will be a short update.…

- Get link

- Other Apps

Dividend Collected (November 2019) and Ascendas Rights Result

Top Dividend Contribution (YTD)

Dividend Collected 2019

Dividend collected for the month of November 2019: $2,341.70

FRASERS L&I TROXLEYMTNB200518MAPLETREE COM TRMAPLETREE NAC TRNETLINK NBN TRKEPPEL DC REITSTARHUBFRASERS CPT TRDBS

Dividend Collected to Date

Dividend (YTD): $15,760.70

Average Mo…

- Get link

- Other Apps

Portfolio Allocation (November 2019) - Mapletree and Ascendas

Stock Allocation

Change Log Allocated MAPLETREE COM TR PO with excessSold MAPLETREE NAC TRBought ASCENDAS REITApplied ASCENDAS REIT R with excess

Portfolio Allocation

There was quite a significant amount of capital injection, due to the Mapletree Comm Trust PO and Ascendas REIT rights issue, for th…

- Get link

- Other Apps

December 2019 Singapore Savings Bond

Application Closes: 9.00pm, 26 Nov 2019

Details on this month SSB can be found on SGS website.

Without any surprises, the rates for SSBs continued to slide. The 10-year interest rate has dropped to the lowest since inception which is at 1.71%. Does the economy really looks so bleak in the future? Th…

- Get link

- Other Apps

Closed Position in Mapletree NAC Trust and Portfolio Performance (October 2019)

Portfolio ReturnsSince Inception (Including Dividends) Total Portfolio Unrealized Gain: $60,858.02 Total Portfolio Realized Gain: $96,549.89

XIRR: 7.72%

Portfolio Value

This week, I closed my position in Mapletree NAC Trust after reading that one of the malls under the REIT, Festival Walk, was targete…

- Get link

- Other Apps

Initiated Position in Ascendas REIT and Dividend Collected (October 2019)

Dividend collected for the month of October 2019: $878.30

OCBC BANKTEMASEKB231025IS USD ASIA BONDIS US ASIA HYG

Dividend (YTD): $13,419.00

Average Monthly Dividend (YTD): $1,341.00

Total Dividend Collected to Date: $88,274.89

The sky is falling! The sky is falling! The last trading day of the week …

- Get link

- Other Apps

Portfolio Allocation (October 2019)

Stock Allocation

Change Log Allocated KEPPEL DC REIT PO with excessSold FAR EAST HTRUSTBought IS ASIA HYG S$DBought NIKKOAM SGBD ETF (SRS)

Portfolio Allocation

The market ends on a high note in October. I did quite a few transactions and some housekeeping for the month.

Firstly, I received the all…

- Get link

- Other Apps

The Start Of My SRS Investing Journey

In short, I have recently created a new SRS account and made my first contribution.

The Supplementary Retirement Scheme (SRS) is for individuals to voluntarily save for their retirement and it complements the existing mandatory Central Provident Fund (CPF) scheme. Although SRS is mainly for retire…

- Get link

- Other Apps

November 2019 Singapore Savings Bond

Application Closes: 9.00pm, 25 Oct 2019

Details on this month SSB can be found on SGS website.

The interest rates continue to drop as expected, and the long term average interest rate is now at the lowest point since the inception of SSBs. The average 1-year interest is at 1.62% and the average 10-y…

- Get link

- Other Apps

Dividend Collected and Portfolio Performance (September 2019)

Dividend collected for the month of September 2019: $1,221.00

ST ENGINEERINGMAPLETREE LOG TRFAR EAST HTRUSTCAPITAR CHINA TR

Dividend (YTD): $12,540.70

Average Monthly Dividend (YTD): $1,393.41

Total Dividend Collected to Date: $87,396.59

Portfolio ReturnsSince Inception (Including Dividends) Total P…

- Get link

- Other Apps

Portfolio Allocation (September 2019)

Stock Allocation

Change Log Allocated CAPITAR CHINA TR PO with excessApplied KEPPEL DC REIT PO with excess

Portfolio Allocation

In early September, I was almost fully allocated for my application in CapitaR China Trust PO. This resulted in the Trust moving to the 6th largest holding in my portfolio…

- Get link

- Other Apps

Did I Apply For Lendlease Global Commercial REIT IPO?

Yes, I did.

I have expressed interest in the IPO in my past few posts, but it was not a firm decision at that point of time as I lack the time to look through and skills to analyst the prospectus. What I would normally do is to read up on the reviews by financial bloggers before making a decision …

- Get link

- Other Apps

October 2019 Singapore Savings Bond

Application Closes: 9.00pm, 25 Sep 2019

Details on this month SSB can be found on SGS website.

The interest rates continue to slide and the 10-year interest has fallen to a low of 1.75%. This is one of the lowest rate since the introduction of Singapore Saving Bonds. The interest rate is at the sam…

- Get link

- Other Apps

Portfolio Performance (August 2019)

Portfolio Returns

Since Inception (Including Dividends) Total Portfolio Unrealized Gain/ Loss: $$51,076.69 Total Portfolio Realized Gain/ Loss: $$95,668.09

XIRR: 7.52%

Portfolio Value

The trade war tension has eased and the Hong Kong protest is seeing less violence this week. Instead of gathering nea…

- Get link

- Other Apps

Dividend Collected (August 2019)

Dividend collected for the month of August 2019: $2,121.37

SINGTELVICOMSHENG SIONGMAPLETREE NAC TRKEPPEL DC REITASPIALTREA200828MAPLETREE COM TRFRASERS CPT TRSTARHUB

Dividend (YTD): $11,387.20

Average Monthly Dividend (YTD): $1,423.40

Total Dividend Collected to Date: $86,243.09

This week, we see F…

- Get link

- Other Apps

Portfolio Allocation (August 2019)

Stock Allocation

Change Log Bought UOBBought DBSBought OCBC BANKApplied CAPITAR CHINA TR with excess

Portfolio Allocation

Due to the escalation in trade war and rates cut, STI has retreated in August and I took the opportunity to do some accumulation. The banking sector caught my attention and I ma…

- Get link

- Other Apps