Posts

Portfolio Allocation Review (Feb 2021) - Bought the Dip

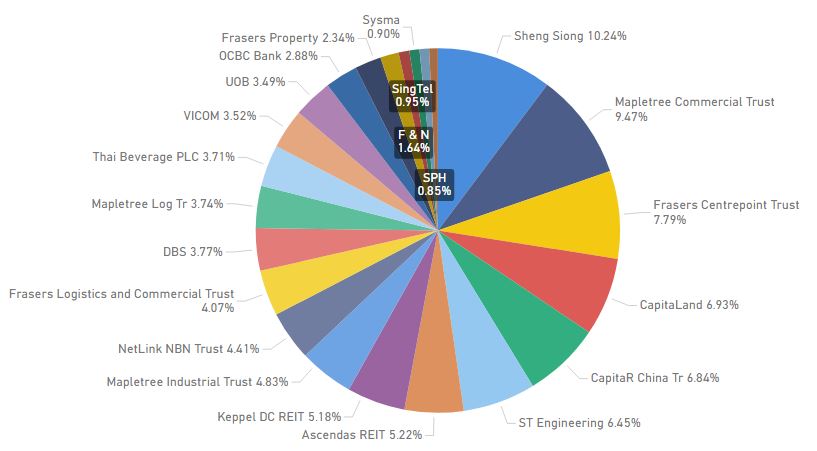

Core Stock Allocation Total Portfolio Allocation

Transaction Summary for February 2021 BOUGHT ISHARES USD ASIA HY BOND ETF (SRS)BOUGHT INVESCO QQQ TRUSTBOUGHT ISHARES CHINA LARGE-CAP ETFBOUGHT MAPLETREE IND TRThe market correction has begun and there was heavy selling, especially in US tech stocks and…

- Get link

- Other Apps

Satellite Portfolio Updates

Satellite Portfolio Allocation HoldingsSPDR Barclays Capital High Yield Bnd ETF, JNKiShares Preferred and Income Securities ETF, PFFVanguard Health Care ETF, VHTInvesco QQQ Trust, QQQiShares China Large-Cap ETF, FXIVanEck Vectors Semiconductor ETF, SMH The markets have started to show some retraceme…

- Get link

- Other Apps

Portfolio Performance Review - ATH (January 2021)

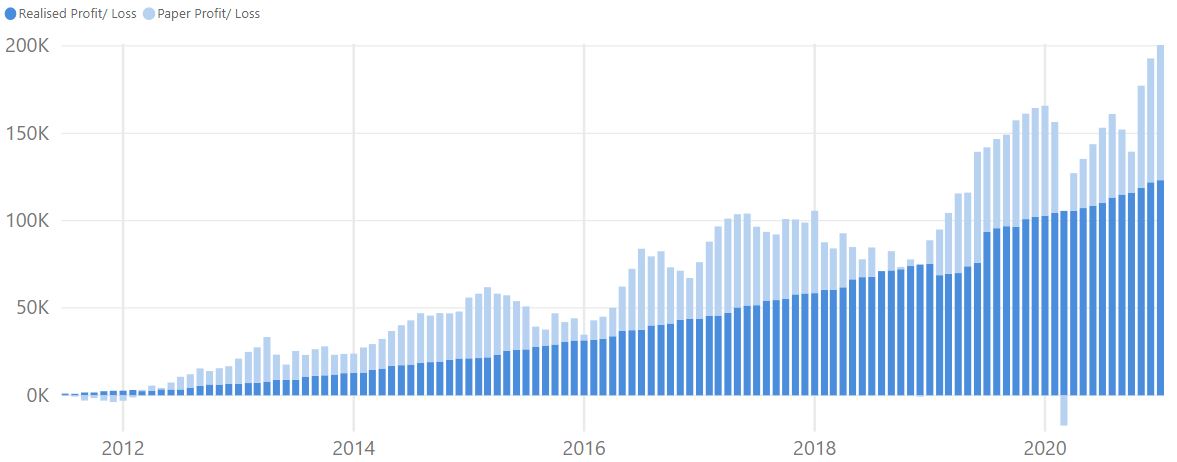

Total Portfolio P/LSince Inception

Total Portfolio Unrealized Gain: $77.38K Total Portfolio Realized Gain (Including Dividends): $123.16K XIRR: 7.36% Portfolio Market Value

STI has been consolidating for the past few weeks while the US markets are making daily highs. Portfolio gain reached all-time hig…

- Get link

- Other Apps

Dividend Collected (January 2021) - Apes Together Strong Part 2

Dividend Collected to Date Dividend by Month (Last 5 Years) Top Dividend Contribution (Last 12 Months)

Dividend collected for the month of January 2021: $1.16K* *Dividends are realized on pay date SINGTELNIKKOAM SGBD ETF Dividend (YTD): $1.16K

Average Monthly Dividend (YTD): $1.16K Total Dividend Collected…

- Get link

- Other Apps