Posts

Portfolio Allocation Review (January 2021) - Apes Together Strong!

Core Stock Allocation Total Portfolio Allocation

Transaction Summary for January 2021 Bought VanEck Vectors Semiconductor ETF, SMH

This week, we witnessed the best financial drama unfolding as

r/wallstreetbets took on the institutional hedge funds. For the first

time we are see…

- Get link

- X

- Other Apps

Satellite Portfolio Updates

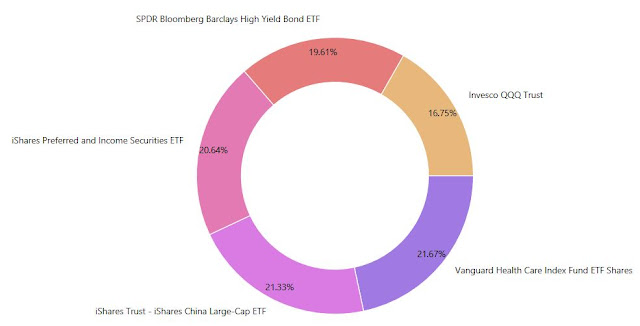

Satellite Portfolio Allocation HoldingsSPDR Barclays Capital High Yield Bnd ETF, JNKiShares Preferred and Income Securities ETF, PFFVanguard Health Care ETF, VHTInvesco QQQ Trust, QQQiShares China Large-Cap ETF, FXI

This week STI is still struggling to hold above 3000 points but the US markets are d…

- Get link

- X

- Other Apps

Portfolio Performance Review - ATH (Decemeber 2020)

Total Portfolio P/L

Since Inception

Total Portfolio Unrealized Gain: $70.90K Total Portfolio Realized Gain (Including Dividends): $121.95K XIRR: 7.25% Portfolio Market Value

This week, STI has regained back above 3000 point levels and

portfolio continued to slowly inch up. The total market value was abl…

- Get link

- X

- Other Apps

Dividend Collected (December 2020)

Dividend Collected to Date Dividend Collected in 2020 Dividend by Month (Last 5 Years) Top Dividend Contribution (Last 12 Months)

Dividend collected for the month of December 2020: $3.23K* *Dividends are realized on pay date MAPLETREE IND TRMAPLETREE LOG TRNETLINK NBN TRFRASERS CPT TRCAPITAR CHINA TRASCE…

- Get link

- X

- Other Apps

Portfolio Allocation Review (December 2020)

Core Stock Allocation Total Portfolio Allocation

Transaction Summary for December 2020ALLOCATED ASCENDAS REIT PREFERENTIAL OFFERINGALLOCATED CAPITAR CHINA TR PREFERENTIAL OFFERINGA happy new year to all my readers and this will be my first short update for 2021!

The US market ended the year at all-tim…

- Get link

- X

- Other Apps