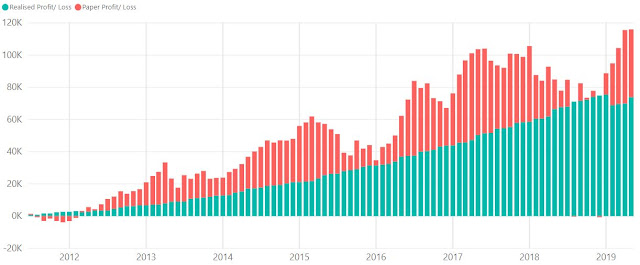

Portfolio Performance (May 2019)

Portfolio Return

|

| As of 31st May 2019 |

Total Portfolio Unrealized Gain/ Loss: $$42,168.44

Total Portfolio Realized Gain/ Loss: $$73,860.50

XIRR: 6.42%

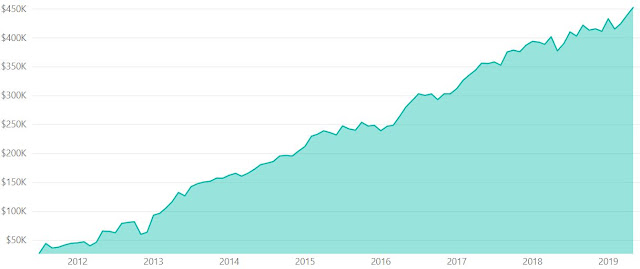

Late in posting this as I did a post on Astrea V first. Portfolio return remains flat for the month of May as the incoming dividends covered the unrealised lost from portfolio. The performance was much better than expected given that the trade war is ongoing. This shows the importance of having a regular income from dividend to support the fluctuations in the market. Portfolio value has also increased to around $450,000 due to capital injections.

Separately, 800 Super cash offer has achieved more 90% and is now unconditional. Offer has been extended to 8 July. I have also accepted the offer and is now just waiting for the deal to complete and receive the payout.

As for Frasers Centrepoint Trust, I received 1000 shares in excess (excluding entitled and rounding shares). I had applied for more than that, but was satisfied with the allocation. The price is now around 10% more than the offered price. Congrats to all those who applied.

Separately, 800 Super cash offer has achieved more 90% and is now unconditional. Offer has been extended to 8 July. I have also accepted the offer and is now just waiting for the deal to complete and receive the payout.

As for Frasers Centrepoint Trust, I received 1000 shares in excess (excluding entitled and rounding shares). I had applied for more than that, but was satisfied with the allocation. The price is now around 10% more than the offered price. Congrats to all those who applied.

Portfolio Value

|

| Portfolio Value (excluding Cash and SSBs) |

InvestingNote Profile: @SingularityTruth

Facebook Page: @SingularityTruth

Comments

Post a Comment