Dividend Collected (March 2020)

Top Dividend Contribution (Last 12 Months)

Dividend Collected to Date

Dividend Collected in 2020

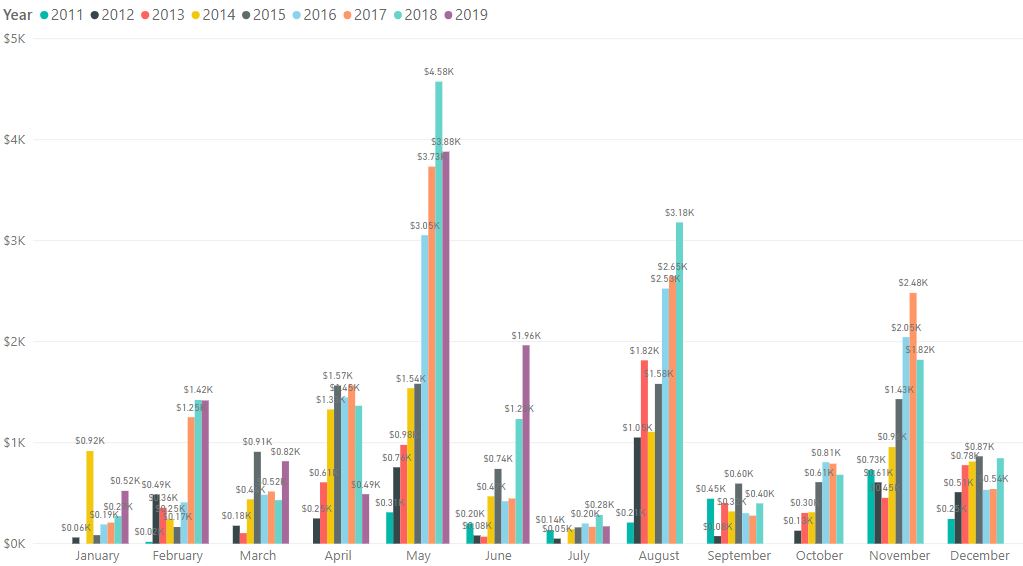

Dividend by Month (Since Inception)

Dividend collected for the month of March 2020: $1.20K

- KEPPEL DC REIT

- ASCENDAS REIT

- MAPLETREE LOG TR

- CAPITAR CHINA TR

Average Monthly Dividend (YTD): $1.16K

Total Dividend Collected to Date: $95.31K

The COVID-19 situation in Singapore has reached a critical stage. The Circuit Breaker a.k.a CB kicks in and the foreign worker dormitories are becoming the virus epicenters in Singapore. After looking at some of the online videos on their living conditions and how cramp their living quarters are, I believe that most of the workers would have been infected by now.

Although the government is doing their best and putting all the resources into reducing the number of workers living in dormitories, I guess it was a little too late. I am expecting the numbers of confirmed cases to spike up rapidly in the following week. More importantly, the medical services would have been overwhelmed and the number of death will start raising.

Despite the escalating situation on ground, the stock market poised a strong rebound and it appears that the low may have been reached. Has the boat left? Who knows? The government around the world are pumping so much money to support their economy so a short term rally is expected. What the market final direction will be is still unknown.

I was recently reading the memos by Howard Marks and he suggested that one should buy when it's cheap despite knowing the fact that things could get worst.

"I think it’s okay to do some buying because things are cheaper. But there’s no logical argument for spending all your cash, given that we have no idea how negative future events will be"

"I no longer feel defense should be favored. Yes, the fundamentals have deteriorated and may deteriorate further, and the disease makes for risk (remember, I'm the one who leans toward the negative case)"

The 2 main points are to start buying but don't showhand.

Many companies were unable to hold their AGM and thus dividend payment will be deferred. We are also starting to see companies cutting their dividend like SPH REIT. Tenants may start defaulting and things could get worst. But as Howard Marks suggests, I would continue to buy knowing that things could get worst. It has already been 1 month since my last purchase, and perhaps, I should do another purchase next week.

Of course, the above probably will only make sense if you are a very long-term investor like me. It will not make sense for short-term trader who makes money both on the way down and up.

Stay home and buy stocks. Stay safe.

InvestingNote Profile: @SingularityTruth

Facebook Page: @SingularityTruth

Hi Singularity Truth, I see that you still collect a healthy stream of dividends given most REITs will slash their dividends due to COVID-19. Like you, I am also a dividend investor for the long term and I hope to build a portfolio like yours.

ReplyDelete