Moving Towards a Core-Satellite Portfolio

Moving Forward

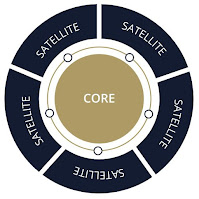

Recently, I have been thinking about my portfolio asset allocation and was wondering if there are any improvements that can be done. I have the habit of reading up on financial blogs and InvestingNote, and so a new idea came up when a came across an article. It was an article on 'Core-Satellite Portfolio' and decided to look deeper.

'Core-Satellite' vs 'Barbell'

I interpret the 'Core-Satellite Portfolio' loosely as having a more conservative larger portfolio as core, and smaller satellite portfolios with higher risk assets. This is similar to the 'Barbell Strategy' which was suggested by DBS CIO. I preferred to use the term 'Core-Satellite' for my portfolio as it highlights the weightage of a larger conservative Core portfolio, and a smaller higher risk Satellite portfolio. Whereas, Barbell may suggests having an equal weightage. Therefore, I would see that a Barbell portfolio is riskier than a Core-Satellite portfolio.

What my portfolio is missing are assets on the other end of the risk spectrum, the higher risk assets. Therefore, I will be building a Satellite portfolio consisting of US ETF and stocks. Obviously, my current holdings will form the Core portfolio which consists of Singapore-listed securities.

Housekeeping

Before I build my Satellite portfolio, I would like to do some 'housekeeping'. There is only one ETF which I have been holding that is listed in the US, iShares Silver Trust (SLV) ETF. I bought this when I started investing thinking that it will be something similar to gold. But I see silver now as an industrial metal instead of an asset that provides store of value. The ETF is held in DBS Vickers Cash account and it is irritating that it incurs custodian fee every quarter. As a result, I sold it and withdrew every dollar out of DBS Vickers.

Building a 'Satellite'

As mentioned in my previous post, I have signed up with Tiger Broker and I will be using it to build my Satellite portfolio of US ETF and stocks. Tiger Broker provides a low-cost option to enter the US markets. So, it will be a high-risk portfolio using a platform with higher risk. The size of the Satellite portfolio will be how much risk I am willing to accept if either the platform or the securities go bust. My plan now is to have 3 securities in the portfolio, and is currently 1/3 completed. I will share more on my Satellite portfolio when completed.

For my Core portfolio, I will continue to accumulate regularly using my DBS Cash-upfront account where the securities will be held safely in CDP.

Disclaimer: This post is not paid advertising or sponsored content. Please do your own due diligence when choosing a brokerage.

InvestingNote Profile: @SingularityTruth

Facebook Page: @SingularityTruth

Comments

Post a Comment