Dividend Collected (December 2020)

Dividend Collected to Date

Dividend Collected in 2020

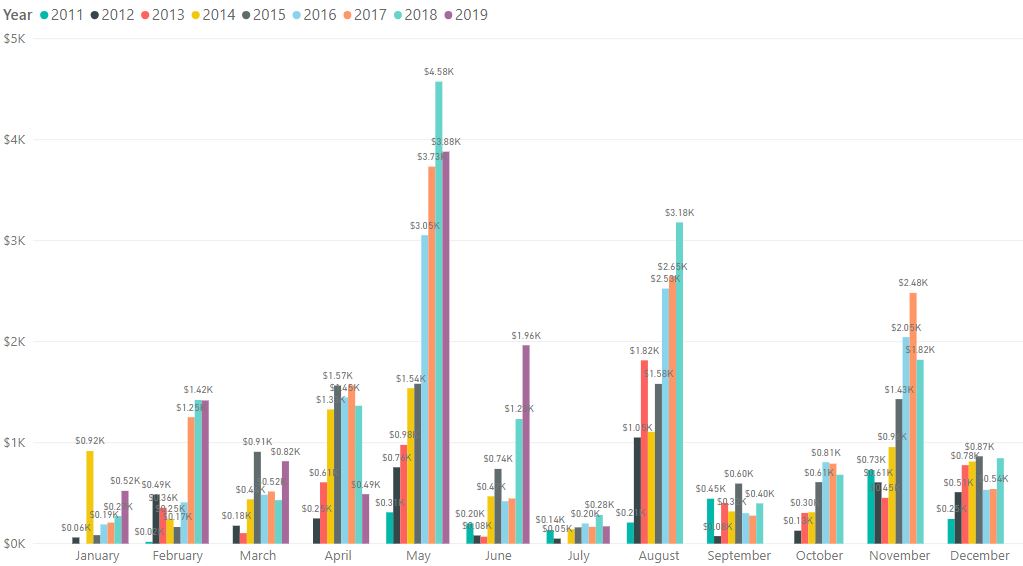

Dividend by Month (Last 5 Years)

Top Dividend Contribution (Last 12 Months)

Dividend collected for the month of December 2020: $3.23K*

*Dividends are realized on pay date

- MAPLETREE IND TR

- MAPLETREE LOG TR

- NETLINK NBN TR

- FRASERS CPT TR

- CAPITAR CHINA TR

- ASCENDAS REIT

- ASTREAIVB280614

- FRASERS L&C TR

- SPH

- ISHARES CHINA LARGE-CAP ETF

- ASTREAVB290620

- VANGARD HEALTH CARE ETF

- DBS

- ISHARES PREFERRED AND INCOME SECURITIES (MONTHLY)

- SPDR BARCLAYS CAPITAL HIGH YIELD BOND (MONTHLY)

Dividend (YTD): $19.87K

Average Monthly Dividend (YTD): $1.66K

Total Dividend Collected to Date: $111.71K

December turns out to be a dividend bumper month with the largest amount

received for the year of 2020. I am very satisfied with the dividends

collected for the whole year which reached close to $20K. Not only did

it exceeded the amount received the previous year, it was achieved in a

year where dividends are capped or cut due to the pandemic.

The amount of dividend collected was equivalent to around $1.66K per

month which was pretty significant. This is akin to getting 2 promotions

for my full-time job. I could also declare that I have FIRE-ed if I can

keep my expenses within that amount. Unfortunately, I have no intention

of retiring yet. I do not have a target for my passive income and will

continue to work as long as there is a need. This year, I will continue

to increase my portfolio size to increase my passive income from

dividends.

The first week of the year is amazing and markets are pretty bullish. US

markets are continuing to make new highs and the STI’s rally seems to be

gathering speed covering lost grounds last year. STI is closing in to

3000 points this week. There could be multiple reasons for the rally. It

could be due to handing over of US president coming soon, and the

Democrats controlling both the House and Senate. As for the STI, it

could be the news of PM Lee taking the vaccine which gave a boost to

investor’s confidence in the Singapore economy.

In such a bullish market environment, there is nothing much to do except

to stay on the sideline and wait for a correction before doing any

accumulation.

InvestingNote Profile: @SingularityTruth

Facebook Page: @SingularityTruth

Comments

Post a Comment