Portfolio Allocation Review (Feb 2021) - Bought the Dip

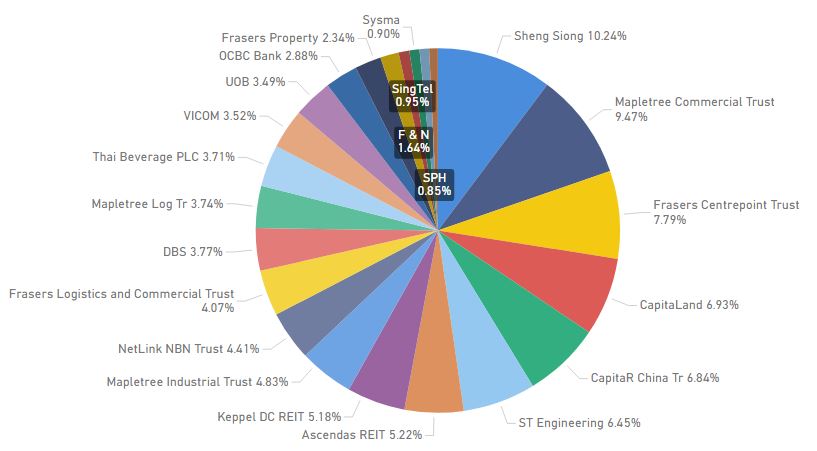

Core Stock Allocation

Total Portfolio Allocation

Transaction Summary for February 2021

- BOUGHT ISHARES USD ASIA HY BOND ETF (SRS)

- BOUGHT INVESCO QQQ TRUST

- BOUGHT ISHARES CHINA LARGE-CAP ETF

- BOUGHT MAPLETREE IND TR

The market correction has begun and there was heavy selling, especially in US tech stocks and local REITs. One sector which stood out was bank which seems to hold well during the sell down. The main reason for the current correction is due to the raising treasury yield. Now that bonds are getting more attractive, investors may have another option to choose from beside stocks.

As a long-term investor, I see this as an opportunity and bought the dip. I have accumulated a local industrial REIT, Mapletree Ind Trust, and some US ETFs. It is possible for the market to continue going downwards moving forward, and I will be gradually accumulating along the way. Always pace yourself and not to go all in at once as no one knows when is the bottom.

My satellite portfolio has been growing and is now around 5% of total investment portfolio. I have placed a few more limit orders last night for some US ETFs but may not be in time to update this post if it gets filled.

InvestingNote Profile: @SingularityTruth

Facebook Page: @SingularityTruth

Comments

Post a Comment