Portfolio Allocation Review (Mar 2021) - Recovery Phase

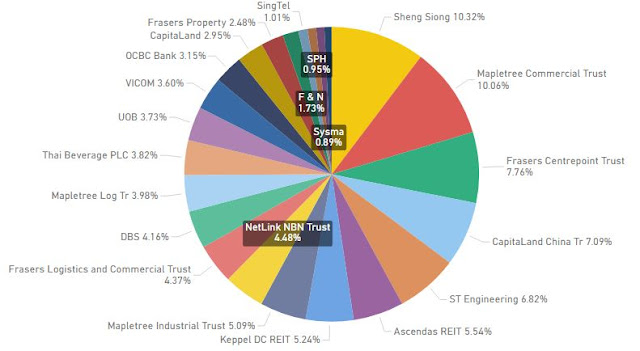

Core Stock Allocation

Total Portfolio Allocation

Satellite Portfolio Allocation

Transaction Summary for March 2021

- BOUGHT VANGUARD HEALTH CARE ETF

- BOUGHT VANECK VECTOR SEMICON ETF

- ALLOCATED ASTREA VI3%B310318

- SOLD PARTIAL CAPITALAND

- BOUGHT TSMC

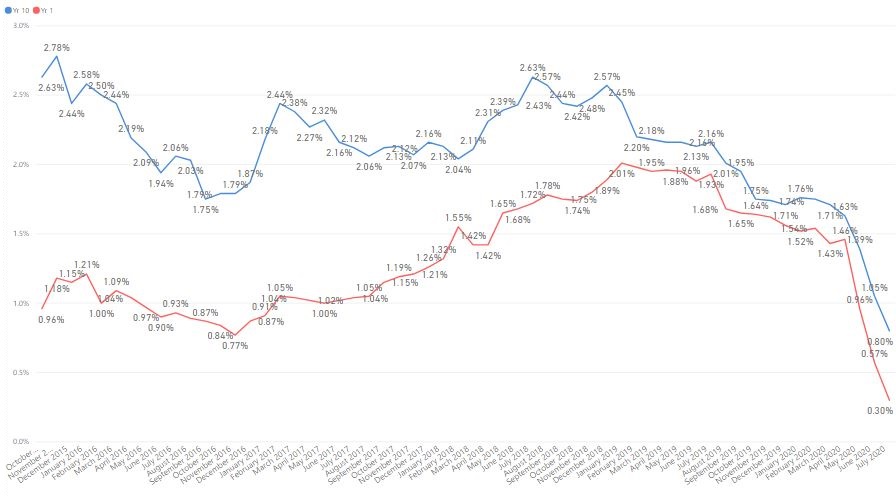

The month of March was pretty bullish as recovery is underway in both the US and Singapore markets. The month started with NASDAQ retreating due to raising treasury yield concerns, and I took the opportunity to continue adding US ETFs for my satellite portfolio. As time progresses, the concern of raising yield wears off, and investor starts returning to the market.

The market rebounded from its low and I also bought my first non-ETF stock in the US market which is TSMC. This is an overlap with my semi-con ETF as I decided to double down on this stock. Overall, the position is still relatively small compared to my local holdings so the risk is still manageable. The satellite portfolio has since increase to 6% of my total portfolio. I am looking to increase it to 10% as the first target.

For the local market, I have applied for the Astrea VI PE bond as expected, and is currently holding all the three retail tranches of Astrea bonds. This looks like it will be a yearly event and I could possibly form a bond ladder from it. The REITs have also rebounded from the low and the banks continued to trend upwards. STI has now gained strong foothold above 3000 points and will be testing the next level, 3200 points.

As for CapitaLand, I have sold partially locking in the gains, but have also retain some of it. If the price is to go higher, I may sell all of it. If the price stays low, I may take the offer. It is still uncertain how the market will valuate CLIM and only time will tell. In any case, the move to privatize a portion of it was a great move as the price gapped up although there was no change in NAV of CapitaLand. This contradicts the saying, the whole is greater than the sum of its parts. In this case, it seems that investor prefer only certain parts of it.

InvestingNote Profile: @SingularityTruth

Facebook Page: @SingularityTruth

Comments

Post a Comment