January 2019 Portfolio Allocation Update

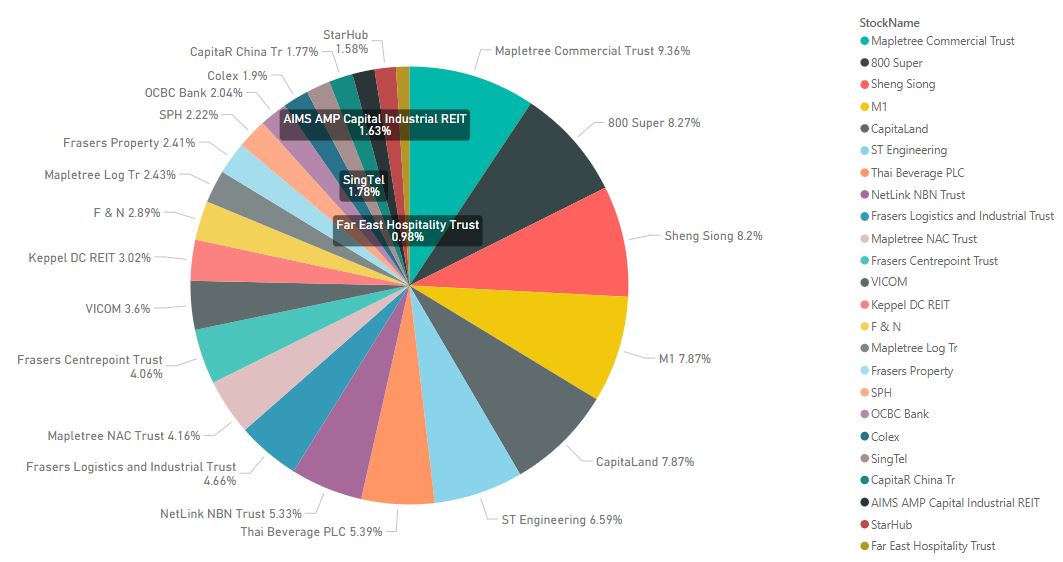

Stock Allocation

Change Log- Added NetLink NBN Trust

My initial plan was to start portfolio capital injection in Feb but the market has turned bullish so quickly that I decided to do a round of capital injection first. I will still continue to add to my portfolio in the next few months.

Separately, I have accepted the VGO for M1. Based on the recent updates, the joint company by Keppel and SPH, Konectivity, only manages to gain an additional 1% of shares that they do not own. I personally think that whether the deal will go through or not largely depends on Axiata which holds a 28.3 per cent stake in M1.

If they accepted the offer, Konectivity will gain majority control over M1 and the deal goes through. The offer might then become unconditional for the remaining investors to accept the offer.

If Axiata decides to continue to be a shareholder and not accept the deal, the deal might be off as it is unlikely for Konectivity to gain additional 17.2% shares from the retail investors. This would probably result in the price of M1 to correct below $2.00 after the deal is off.

I do hope that the deal will be successful.

Comments

Post a Comment