Satellite Portfolio Updates

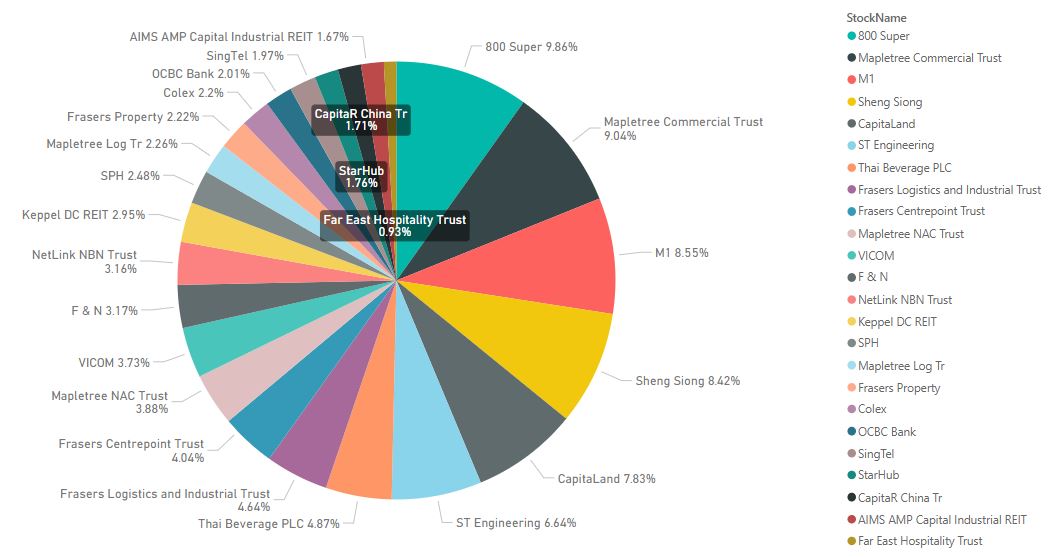

Satellite Portfolio Allocation

Holdings

- Vanguard Health Care ETF, VHT

- Invesco QQQ Trust, QQQ

- iShares China Large-Cap ETF, FXI

- VanEck Vectors Semiconductor ETF, SMH

- ASML Holding NV, ASML

- Micron Technology, MU

- Taiwan Semiconductor Manufacturing Company, TSMC

- Tesla Motor, TSLA

New Transactions

- Accumulate iShares China Large-Cap ETF, FXI

- Accumulate ASML Holding NV, ASML

- Added Tesla Motor, TSLA

Satellite Portfolio Performance

My satellite portfolio has undergone major changes as I closed all my positions in dividend stocks. I then added specific growth stocks which mainly are in the semiconductor sector. This makes the portfolio very focus on growth as the main driver. This month, the US market had a few dips due to inflation fears and I made some accumulations along the way. I have also initiated a new small position in Tesla.

The highlight of this week is the crypto crash. This is my first time witnessing such a big crash as crypto went down over 40% in a few hours. As I have only entered crypto a few weeks back, the fall was unexpected, but the lost was manageable as the positions are relatively small compared to my other portfolios. I then took the opportunity to average down by accumulating more BTC and BNB.

As for the local market, the market immediately rebounded when it opens this week after entering Phase 2 (Heighten Alert). The retracement lasted only 1 day, and so far, the market is still holding up quite well despite the C19 situation worsening. I didn’t get the opportunity to enter but there will be an upcoming Preferential Offering for MIT which I will be interested to subscribe.

InvestingNote Profile: @SingularityTruth

Facebook Page: @SingularityTruth

WciafaMria-ga1983 Nathan Castillo ESET NOD32 Smart Security

ReplyDeleteMcAfee Internet Security

Firefox browser

lolimodast

Mlalaqui_po Joe Bonsness Software

ReplyDeleteget

icdedere