Portfolio Performance Review (Feb 2021)

Total Portfolio P/L

| |

|

Since Inception

Total Portfolio Unrealized Gain: $66.25K

Total Portfolio Unrealized Gain: $66.25K

Total Portfolio Realized Gain (Including Dividends): $123.87K

XIRR: 6.96%

Portfolio Market Value

|

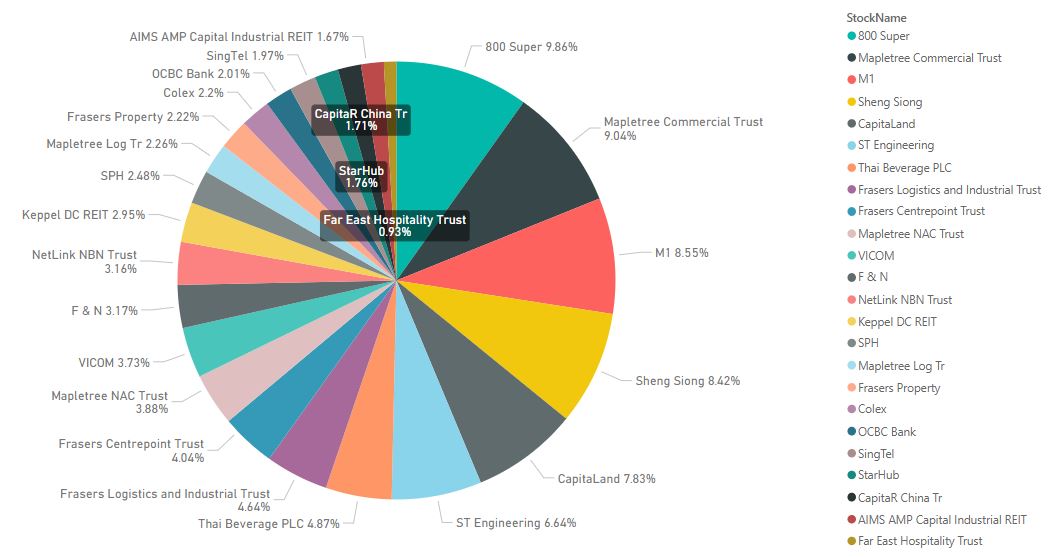

| Portfolio Market Value (excluding Cash and SSBs) |

In Feb, the performance of my portfolio took a turn and has started to come down due to the rising treasury yield. The REITs and NASDAQ ETF are greatly affected, and are undergoing correction at moment. The market remains volatile currently and is extremely sensitive to the moving treasury yield. I will continue to accumulate occasionally on dips. The downtrend may last longer than what I have expected.

Astrea VI PE Bond

There is an upcoming Astrea VI private equity bonds IPO which I will subscribing to. I have subscribed to the previous 2 issues and I think it provide good diversification to my equity-heavy weighted portfolio. Due to the low interest rate environment, the latest issue provides the lowest interest rate out of the three, which is only 3% for a 5 years callable bond. Nonetheless, I will still be subscribing mainly to provide diversification. I suspect there will be more issues coming in the future and there is a possibility of creating a PE bond ladder that consistently provide income.

Frasers Property Limited Rights

Lastly, there is the Frasers Property Limited rights issue which I am not very keen to exercise. Although the rights are renounceable, selling the rights are pretty worthless now as the market price is close to the issue price. I may just let the rights lapsed. There are a few more weeks for me to think through. If the market price falls below the issue price, I can also buy it directly from the open market.

InvestingNote Profile: @SingularityTruth

Facebook Page: @SingularityTruth

Comments

Post a Comment