Satellite Portfolio Updates

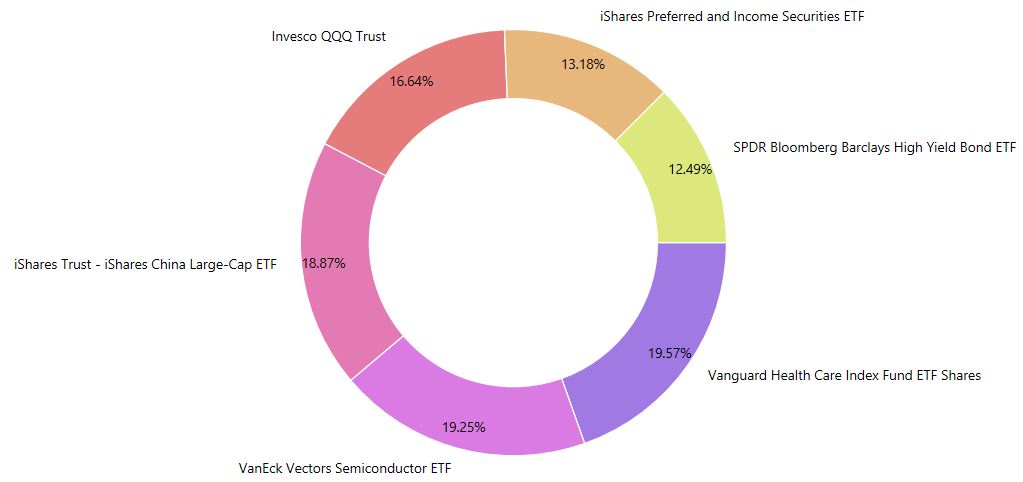

Satellite Portfolio Allocation

Holdings

- SPDR Barclays Capital High Yield Bnd ETF, JNK

- iShares Preferred and Income Securities ETF, PFF

- Vanguard Health Care ETF, VHT

- Invesco QQQ Trust, QQQ

- iShares China Large-Cap ETF, FXI

- VanEck Vectors Semiconductor ETF, SMH

New Transactions

- Accumulate VanEck Vectors Semiconductor ETF, SMH

- Accumulate Vanguard Health Care ETF, VHT

When the yield curve flattens, people are expecting the future economy growth to slow down and the market comes down. When the yield curve steepens, the bonds yields are becoming more attractive compare to equities and people rotate out of equities, resulting in market to come down. In conclusion, the market is constantly expecting a sell down throughout the year regardless of the bond yields. If only predicting the market is so easy…

Market moves in either way and it is the people that frame it such that a particular factor is influencing the market direction. Instead of trying to find a reason to justify the movement in the market, I will just try my best to buy on dips. In fact, I missed most time to buy at the lowest but over a period time, it will average out to a lower purchase price. Assuming the market is on a long-term uptrend, I will then be able make some capital gains.

Due to the concern of raising treasury yield, REITs and growth stocks are undergoing retracement. I have accumulated some US ETFs on the dip and will continue doing so moving forward. As the brokerage fees are relatively cheap, I am able to do more frequent accumulations but in smaller amount. I have also recently opened a new account with Futu MooMoo to get the 1 free Apple stock. But since it just 1 stock, I will not be including it as part of my portfolio.

InvestingNote Profile: @SingularityTruth

Facebook Page: @SingularityTruth

Comments

Post a Comment