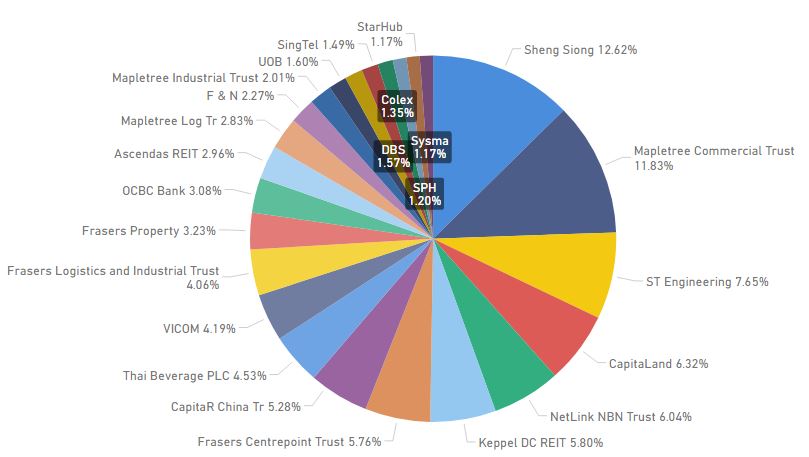

Portfolio Allocation (April 2020)

There was no transaction done for the month of April. One noticeable change in my portfolio is that Sheng Siong has overtook Mapletree Comm Trust to become the largest holding. This is due to the accumulation in March, rally in price for Sheng Siong, and the fall of MCT price. MCT has been my largest holding for the longest time I can remembered.

STI has recovered around 17% from the low in March and had increased around 6% for the month of April. A number of REITs have released their quarterly results in April, and so far I see that retail REITs are the ones that are badly impacted. These REITs failed to rebound much despite raising STI, and had the most dividend cut. For e.g. CMT has DPU cut by 70%. The most anticipated result of DBS was also released on the last day of April.

STI has recovered around 17% from the low in March and had increased around 6% for the month of April. A number of REITs have released their quarterly results in April, and so far I see that retail REITs are the ones that are badly impacted. These REITs failed to rebound much despite raising STI, and had the most dividend cut. For e.g. CMT has DPU cut by 70%. The most anticipated result of DBS was also released on the last day of April.

DBS first-quarter net profit fell 29% y-o-y. This is due to the bank setting aside $1.09 billion to cover potential losses from the pandemic. The surprising thing is that DBS has decided to not to cut dividend and declared an interim dividend of $0.33 per share. This is the same as last quarter and an increase y-o-y. This resulted in the bank’s shares to jumped close to 4%, lifting the whole Singapore market with it.

Although the results are better than expected, this does not mean that DBS is out of the woods yet as Q2 results will probably be worst off than this quarter. Nevertheless, the payout of dividends will provide very strong price support. Sadly, I would have to say that the boat has left and the price would probably not reach the the low in March anytime soon. For the long term investor, each pullback is still an opportunity to enter.

MAS has said that Singapore will go into recession and is projected to be worst than the initial projection of -1% to -4% contraction in GDP. There was an article suggesting retrenchment will hit 100,000 and unemployment will be around 4-5% for Singapore. Despite the gloomy outlook in the economy, the stock market is still raising. The disconnect makes it even harder to time the market, so regular purchasing is still the easiest strategy for long term investor.

May is here and hopefully the seasonal adage "sell in May and go away" will come true so I can do my accumulation. My cash holding is closed to 20% and waiting for deployment.

May is here and hopefully the seasonal adage "sell in May and go away" will come true so I can do my accumulation. My cash holding is closed to 20% and waiting for deployment.

InvestingNote Profile: @SingularityTruth

Facebook Page: @SingularityTruth

It might not be a disconnect between the economy and stock market.

ReplyDeleteIt might be due to the stock market being 6 mths ahead of the economy. In other words, the stock market is pricing in that 6 mths later, economy will be better.