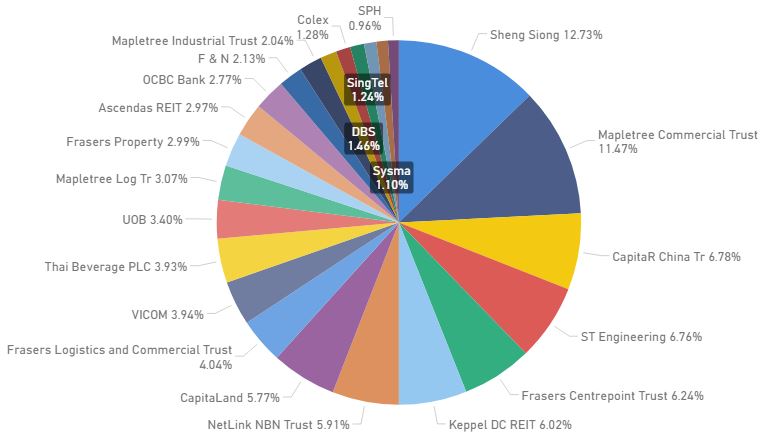

Portfolio Allocation (May 2020)

Stock Allocation

Transaction Summary for May 2020

- BOUGHT UOB

- BOUGHT CAPITAR CHINA TRUST

- REDEEMED OXLEYMTNB200518

Portfolio Allocation

Sell in May did not occur and STI was generally in consolidation mode for the month. Despite this, I went in and made two purchases. One of which was UOB and the other was CapitaR China Trust. I am an existing holder for both stocks and was accumulating and averaging down. Although I am expecting a worst Q2 results, I could not determine whether the Q2 performance has already been factored into the current price. Both are for long term holdings so the fluctuations during these few quarters won't matter much to me. I will still be able to average down if the price comes down further in the next few months if the fundamentals did not change.

The recession in Singapore will be worse than expected and MTI has revised the GDP for the year to -7% to -4% from -4% to -1% previously. But the worst seemed to be over for the pandemic situation. We are coming to the end of the CB and going into Phase 1 where the economy will be reopening gradually. The announcement of Phase 2 where almost the entire economy will resume operations, which could come before end June, caused a breakout in the REITs sector on the last trading day. The sentiments have turned bullish as people is anticipating things to return to normal soon.

InvestingNote Profile: @SingularityTruth

Facebook Page: @SingularityTruth

Comments

Post a Comment