GamePlan for A New Economy and Portfolio P/L Updates (July 2020)

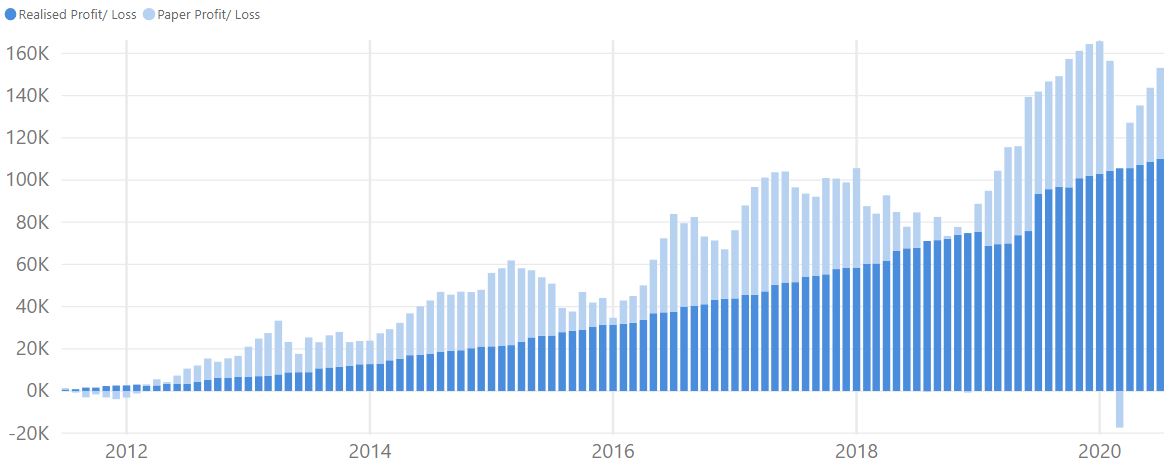

Portfolio P/L

|

| As of 31 July 2020 |

Since Inception (Including Dividends)

Total Portfolio Unrealized Gain: $43.09K

Total Portfolio Unrealized Gain: $43.09K

Total Portfolio Realized Gain: $110.08K

XIRR: 6.44%

Portfolio Market Value

| |

|

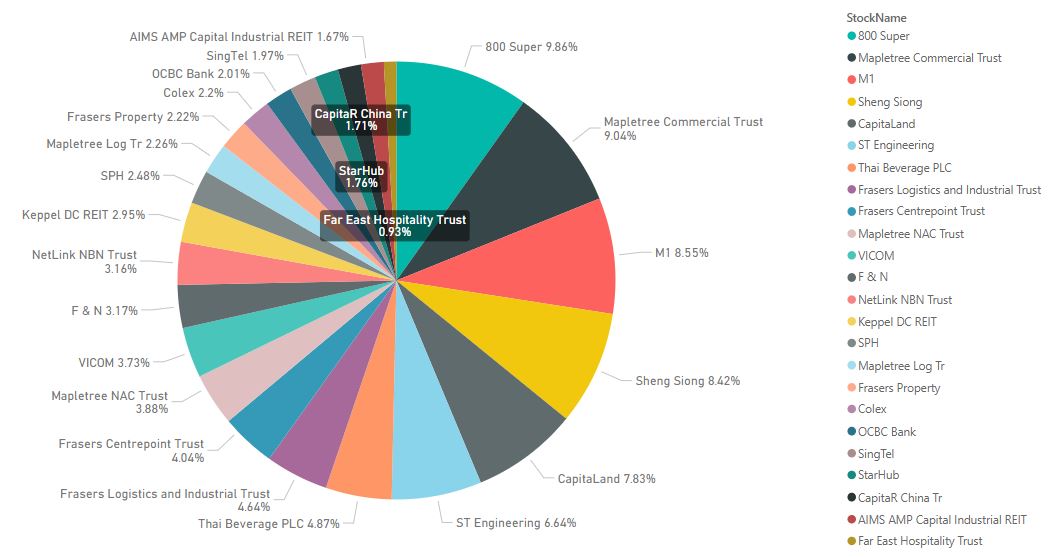

Portfolio Unrealized P/L Breakdown

MTI further downgrades Singapore’s GDP outlook to -5% to -7%, and it looks like the economy will not be able to just wait out until COVID-19 is over. We will have to change and prepare for a new economy, specifically, a new economy without tourism and lower trade, which Singapore is heavily reliant on. Therefore, I remain pessimistic on the economy for the next 1-2 years.

Sectors such as airline and hospitality will have to change or face elimination. These are what I classified as Tier 1 risk sectors which are directly impacted. Tier 2 are sectors which I classified as indirectly impacted such as retail, properties, MICE, banks and transportation. Tier 3 are sectors which could sustain or even perform better such as technology, healthcare, logistic and consumer staple. The lists are not exhaustive and are just some of the more obvious ones. This will be what the new economy looks like.

I will be adjusting my overall portfolio to better reflect the new economy. Tier 1 sectors are companies which I will never buy no matter how cheap the prices are. As for Tier 2, I will be accumulating over the next few years but I feel it is still too early for recovery play so accumulation will be paced widely. For the short term, I will be adding companies that are in the Tier 3 sectors. This will be the game plan until COVID-19 is over.

As for portfolio performance, it is still on the road to recovery. I am satisfied with the performance for my satellite portfolio so far, which has started contributing both dividend and unrealized gain to the overall portfolio.

InvestingNote Profile: @SingularityTruth

Facebook Page: @SingularityTruth

Comments

Post a Comment