Satellite Portfolio Update - I FOMO-ed

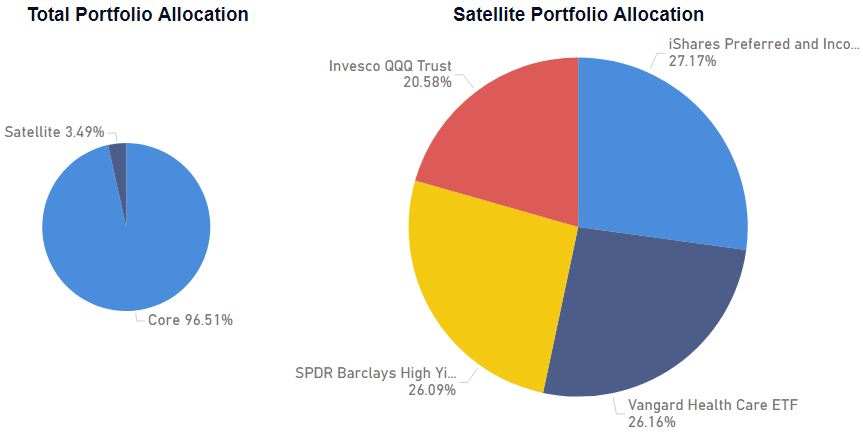

Holdings

- SPDR Barclays Capital High Yield Bnd, JNK

- iShares Preferred and Income Securities, PFF

- Vanguard Health Care, VHT

- Invesco QQQ, QQQ

The focus this week fell on the announcement of Fed’s monetary policy review.

The Fed has announced that the agency will be adopting the average inflation

targeting framework moving forward.

The average inflation which the Fed will be targeting is 2%. This would mean

that the inflation will be allowed to overshoot or undershoot 2%, depending on

past inflation rates to achieve an average of 2% over time. Previously,

inflation rate target was set strictly at 2% and past inflation rates were not

taken into consideration.

Having said that, the inflation rates for the past few quarters have been

below 2%. The Fed will not intervene with the inflation rate, by raising

interest rates, when it reaches 2%. It will be allowed to overshoot 2%.

Therefore, the environment we are looking at in the short to medium term will

be of low interest rates and raising inflation.

In fact, the announcement did not came as a surprise since Fed had said that

negative interest rates and yield curve control measures are not favorable.

Another blogger, Financial Horse, also wrote a well-thought article on it and

concluded that inflation is the only way out.

As updated in my last post, I pretty much FOMO-ed and added SPDR Gold Shares

and Invesco QQQ hoping to board the train. The reason for gold is to hedge

against inflation and the falling Dollar. The reason for broad-based Tech ETF

is because of the low interest rate environment and the least impacted by the

pandemic. Of course, both have already run up significantly and there are

talks that the bubble might burst soon. I do not know when the bubble will

burst, and I did some simple risk management by keeping the allocation small.

As a result, my satellite portfolio is only around 3.5% of my total

portfolio.

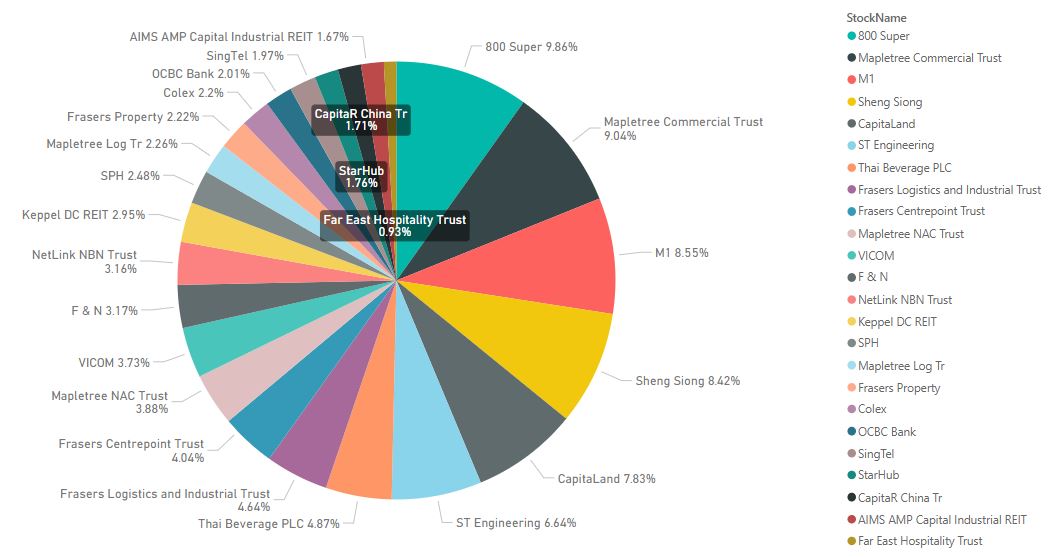

As for my core portfolio, it is more or less in hibernation mode as I think

that local stocks will be in consolidation as dividends are throttled in the

near future. There is no need for me to rush into recovery play at the moment.

InvestingNote Profile: @SingularityTruth

Facebook Page: @SingularityTruth

Comments

Post a Comment