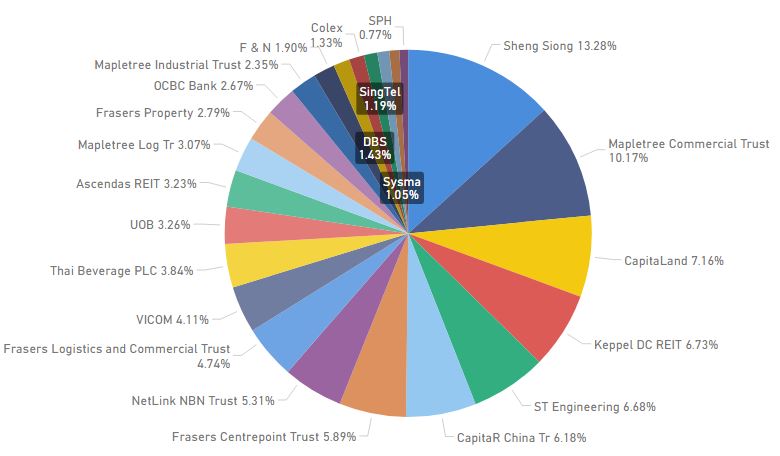

Portfolio Allocation (July 2020)

Stock Allocation

Portfolio Allocation

Transaction Summary for July 2020

- BOUGHT ISHARES PREFERRED AND INCOME SECURITIES ETF

- BOUGHT VANGUARD HEALTH CARE ETF

- SOLD XT CHINA50 US$

For the month of July, I had not made any purchase for the Singapore market, and only added ETFs into my satellite portfolio mentioned in my previous post. I also sold one of the Xtrackers ETFs as they are exiting from SGX and will be delisted. STI was down for the month, and the outlook for the economy of Singapore looks bleak. The reason for saying that is due to the recent intervention by MAS. MAS is calling local banks to cap their dividend for the next 12 months to 60% of their distribution in FY19.

I see this as a drastic move, and is essentially raising the alarm for the banks to start preparing for the challenging times ahead. Despite having the confidence in the local banks to not go into default, MAS is forecasting that there might be a shortage of liquidity if the banks do not conserve their cash now. The liquidity is required for banks to loan to distress businesses in order to save the overall economy. This measure is done at the expenses of investors, and as expected, this will result in the outflow of funds. But, saving the economy is of course the priority compared to the interest of shareholders.

Having said that, I will have to adjust my rate of accumulation by widening the pace. I will do less buying and prepare for a weaker economy in the next 12 months. This does not mean I will start selling or stop buying, just buying at a lower frequency, at least for the Singapore market. I will have to follow where the money goes, which is the US market. The US market is flooded with liquidity from the stimulus packages, and so, I will be expanding my satellite portfolio in the following few months.

InvestingNote Profile: @SingularityTruth

Facebook Page: @SingularityTruth

Comments

Post a Comment