Portfolio P/L Updates (August 2020)

Total Portfolio P/L

| |

|

Since Inception

Total Portfolio Unrealized Gain: $43.09K

Total Portfolio Unrealized Gain: $43.09K

Total Portfolio Realized Gain (Including Dividends): $110.08K

XIRR: 6.44%

Portfolio Market Value

|

| Portfolio Market Value (excluding Cash and SSBs) |

Total portfolio performance is now closed to pre-COVID levels and total portfolio value has reached all time high due to the capital injections done regularly over the pandemic period. Capital injections will continue throughout the remaining of the year into both the Singapore and US markets.

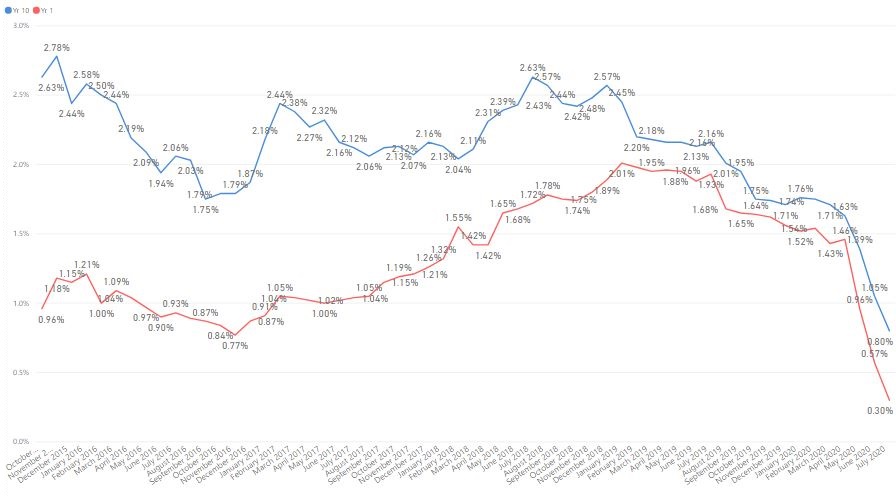

The lacklustre performance of STI will be expected for quite some time as there is no catalyst or any positive news ahead. The local banks’ dividends are capped and interest rates are expected to remain low. For retail REITs, domestic demands itself are not sufficient to recover to post-COVID levels. Hospitality REITs are required to transform or face extinction. Only industrial and logistic REITs are holding up at the moment. STI does not have any high growth constituents like technology stocks so there is little room for STI to move upwards compared to other markets. Overall, the outlook is still not optimistic and I have slowed down my accumulation in local stocks.

I am looking at the US markets more often now and is looking to add a China ETF to my satellite portfolio in the short term.

InvestingNote Profile: @SingularityTruth

Facebook Page: @SingularityTruth

Comments

Post a Comment