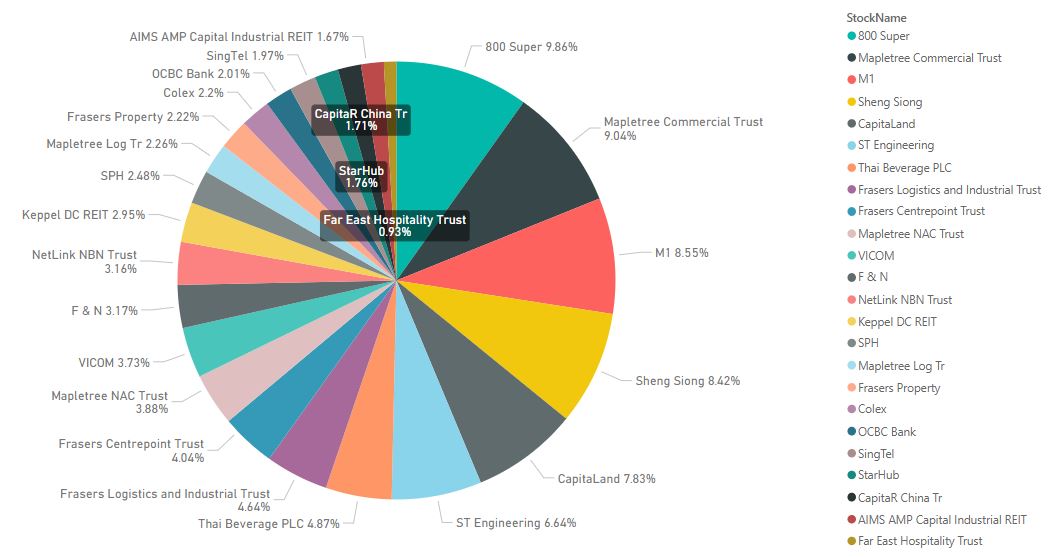

Portfolio P/L Updates - Sector Rotation

Total Portfolio P/L

Total Portfolio Realized Gain (Including Dividends):

$$116.03K

XIRR: 6.56%

Portfolio Market Value

|

|

|

Normally, I will take a snapshot of my portfolio performance at the end of the

month, but I am too excited to look at it this weekend. There was some good

news which resulted a big rotation within the stock market.

Last month, my portfolio took a dive as there was heavy selling into REIT and

Property counters. Luckily, I did take the opportunity to do some

accumulations. After the US election results are out this month, the market

begins to rally.

This week, with the announcement of the preliminary result from a phase 3

vaccine trial which achieved more than 90% efficacy, again triggered another

rally and a big rotation within the stock market. Those sectors which are hit

hard by COVID previously saw strong buying, and those sectors which held up or

has stock price increases during the pandemic saw heavy selling. For e.g.,

stocks that went up include banks, properties, retail REITs, and stocks that

went down includes industrial/ logistic and datacenter REITs. Although the

rally was not the broad-based recovery which I was hoping for, my portfolio

still increases overall.

The total profit, which includes realized and unrealized gains have exceeded

pre-COVID levels at this moment. Unrealized gains doubled compared to last

month due to the rally and sector rotation. It is always exciting to see

portfolio runs like this. However, as my investment philosophy is to invest

for the long term with a focus on passive income, I will not be taking any

profit. I am still in the accumulation phase, and will want the portfolio to

grow as big as possible, and to continue collecting dividends as long as I

could.

Lastly, a wave of rights issue is ongoing for REITs, with Ascendas REIT being

the latest to do a preferential offering. I will decide towards the closing

date as to whether to take part or not, depending on the price of counter. As

for the previous PO for MLT, I ended up not taking part as the price went

below the PO price on the closing date. I had bought both Ascendas REIT and

MLT below the PO price in October so it’s ok for me to not take part in the

PO.

InvestingNote Profile: @SingularityTruth

Facebook Page: @SingularityTruth

Comments

Post a Comment