Portfolio Performance Review (August 2021)

Total Portfolio P&L

| |

|

Since Inception

Total Portfolio Unrealized Gain: $69.77KTotal Portfolio Realized Gain (Including Dividends): $154.72K XIRR: 7.31%

Total Portfolio Unrealized Gain: $69.77K

Portfolio Market Value

| |

|

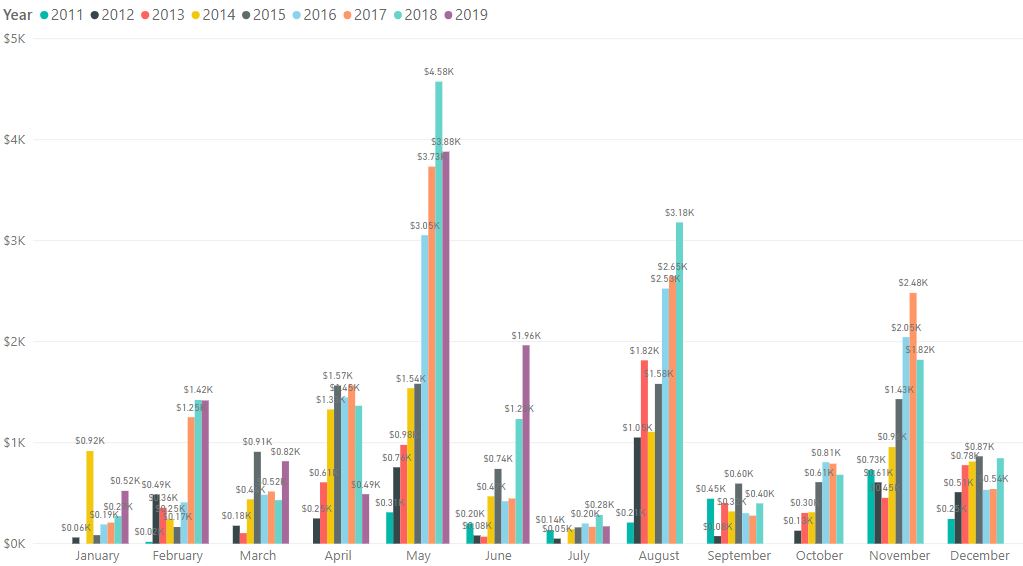

The sentiment in the market has started to turn bearish as lesser people are buying the dip. The tapering will start soon in the next few months which could be the reason why people are more cautious now. As the increase in interest rates are not expected yet, we are only seeing slight profit taking instead of major corrections.

China market is still not out of the wood yet as the next sector, casino, came under review. This impacted gambling related stocks greatly, especially those listed in Macau. Even the price of local listed stock, Genting Singapore came down.

China Evergrande is another important aspect to pay attention to. It is one of the biggest real estate developers in China and is at the brink of bankruptcy. Will China bail out the company or let it collapse? The problem with China is that it does not act like a typical country. If this happens in other countries, it will be too big to fail and will be bailed out by the government to prevent a domino effect impacting other smaller companies. But China may have the power to contain the fall or simply take over the company as state-owned.

Overall, the downtrend remains and I have no intention to buy the dip at the moment.

Comments

Post a Comment