Singapore Savings Bonds September 2018

|

| Sep 2018 Issue |

|

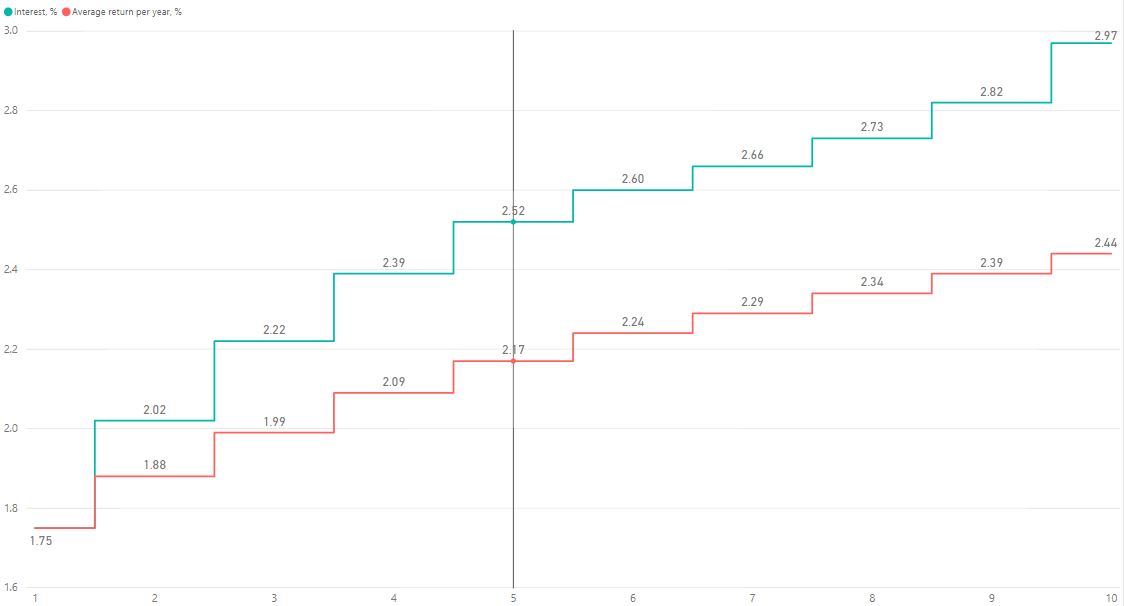

| Average interest per annual for 1-year and 10-year period |

I will probably not be adding any SSB until the next interest hike in September. Around 3.6% of my portfolio is currently in SSB.

Details on this month SSB can be found on SGS website.

Hi! Good summary of the SSB over the months.

ReplyDeleteI was thinking of starting to subscribe to SSB this month but I notice that the interest has started to dip. Given that interest are rising, it should keep going up marginally. Do you mind sharing your view on why is there a drop for Sep issue and your reason to wait for the next issue? Thanks.

News that mentioned rate hikes mainly affects the short-term and not the long-term rates. If you look at SSBs for short holding period e.g. 1 year, the interest rates have trend upwards over the year. The fluctuations in long-term rates are affected by macroeconomic factors which are hard to predict. The current interest rate trend is aligned with news that yield curve inversion is forming meaning that short-term interest rate is rising and long-term interest rate is falling.

DeleteIf you are look at holding SSBs for 10 years, then probably entering at which month does not matter and note there will be opportunity cost for waiting. I have just added SSBs last month so I am not looking at adding more unless the interest rate is very attractive.