August 2018 Portfolio Updates

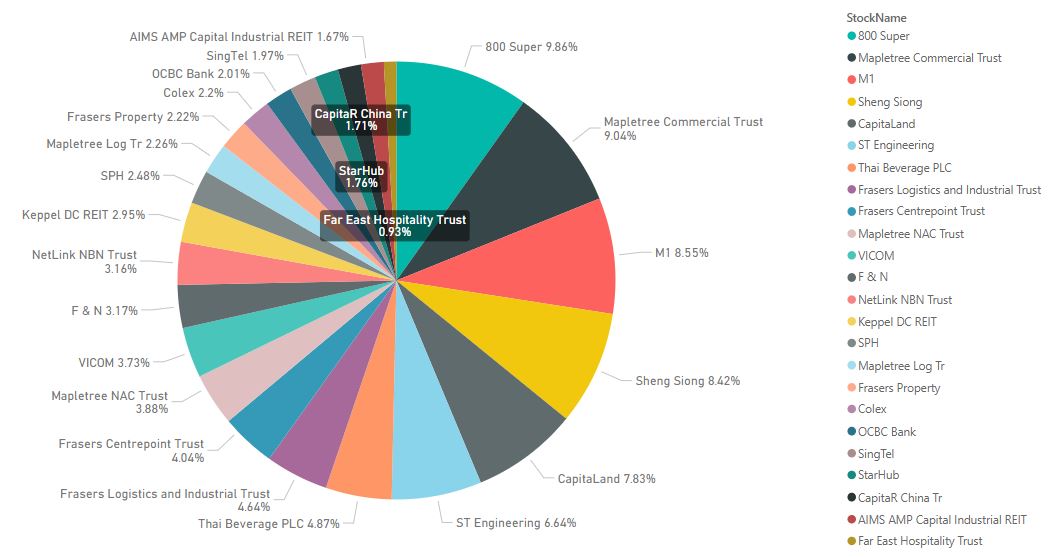

Stock Allocation

There was no stock transaction done for the month of August 2018. Hopefully, there will be opportunities next month as the trade war reignites.

Asset Allocation

Change Log- Added NikkoAM SGD IGBond ETF

As mentioned here, I have subscribed to the NikkoAM SGD IGBond ETF as part of my asset allocation diversification strategy but the allocation is less than 2% of my overall portfolio. The fund size has since grew from around S$83 million on the day of issuance to S$261.46 million as of 30 August 2018. The interest in the fund is better than what I had expected. The NikkoAM ABF Singapore Bond Index Fund current size is S$754.14 million.

The US market has the longest bull run in history although the trade war with China is still ongoing. As a result, the Singapore and emerging markets remain weak as most funds are moved to the US market. The allocation of stock in my portfolio has decreased and I will be looking at re-balancing with defensive stocks. I will also be adding more non-equities assets so that the allocation of cash can be reduced.

The US market has the longest bull run in history although the trade war with China is still ongoing. As a result, the Singapore and emerging markets remain weak as most funds are moved to the US market. The allocation of stock in my portfolio has decreased and I will be looking at re-balancing with defensive stocks. I will also be adding more non-equities assets so that the allocation of cash can be reduced.

Comments

Post a Comment