Singapore Savings Bonds October 2018

|

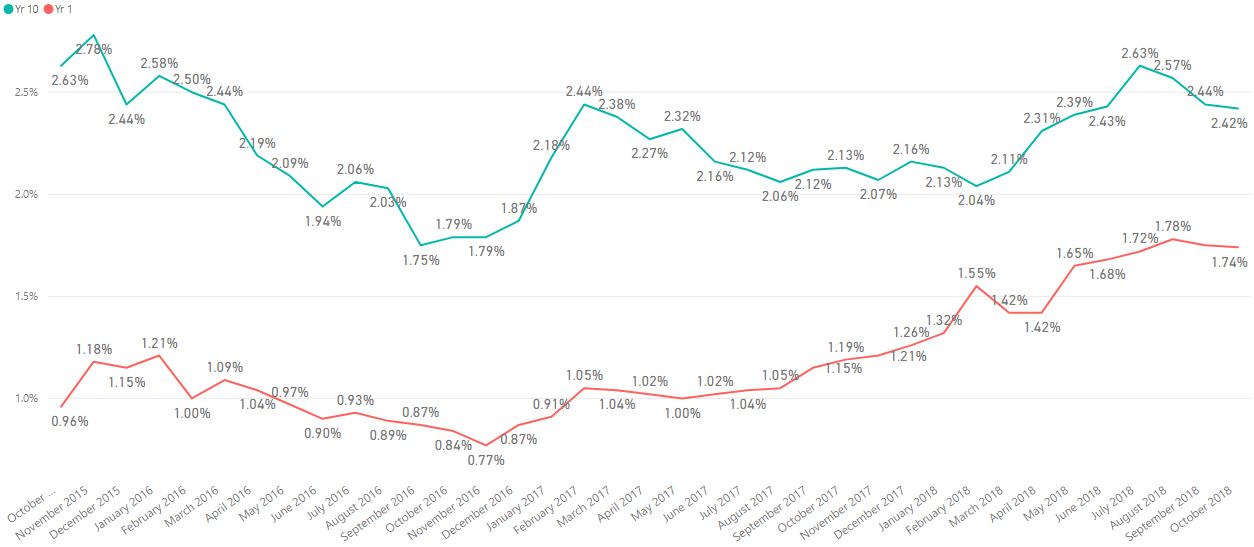

| Average interest per annual for 1-year and 10-year period |

For those who are interested in 'timing' the rates before subscribing, you would have read that the US central bank is looking at 2 more interest rate hikes by the end of the year as US economy continues to expand at a faster pace. The hikes will result in the short-term rates to rise. The current SSBs interest rates trend is showing that the yield curve is flattening which is similar to the US treasury yields. This means that the short-term interest rate is rising and long-term interest rate is falling, probably due to the not so optimistic economic outlook in the long-run. The yield curve will only inverts if the interest for short-term bond exceeds the interest for long-term bond. Yield curve inversion could be associated with upcoming recession according to past history. But the fluctuations in long-term rate are hard to predict as it will be influenced by macroeconomic factors and no one knows exactly what the economy will be like in 10 years time. Whether the yield curve will invert is still an unknown.

Therefore, if you are looking at holding SSBs for 10 years, then probably subscribing at which month does not matter much and take note that there will be opportunity cost for waiting. There is the possibility that the interest rates could fall further for 10-year bonds. For those who are planning to hold for short-term (1 or 2-years), you can then pay attention to the US central bank interest rate hike before deciding whether to subscribe or not. SSBs is definitely an attractive option to park your money for diversification, or as a temporary holding while waiting for opportunities to enter the market.

Therefore, if you are looking at holding SSBs for 10 years, then probably subscribing at which month does not matter much and take note that there will be opportunity cost for waiting. There is the possibility that the interest rates could fall further for 10-year bonds. For those who are planning to hold for short-term (1 or 2-years), you can then pay attention to the US central bank interest rate hike before deciding whether to subscribe or not. SSBs is definitely an attractive option to park your money for diversification, or as a temporary holding while waiting for opportunities to enter the market.

|

| Oct 2018 Issue |

Details on this month SSB can be found on SGS website.

Comments

Post a Comment