Dividend Collected (September 2020)

Dividend Collected to Date

Dividend Collected in 2020

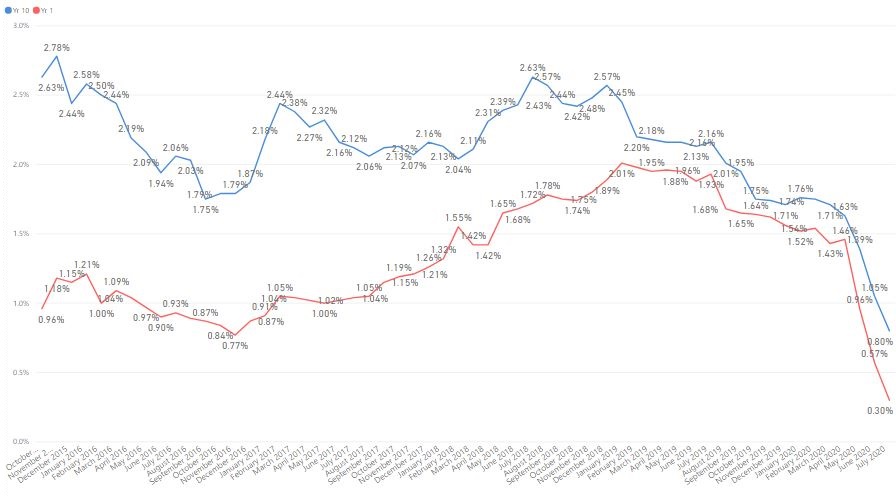

Dividend by Month (Last 5 Years)

Top Dividend Contribution (Last 12 Months)

Dividend collected for the month of September 2020: $2.95K

- KEPPEL DC REIT

- ST ENGINEERING

- STARHUB

- MAPLETREE LOG TR

- CAPITAR CHINA TR

- ISHARES PREFERRED AND INCOME SECURITIES (MONTHLY)

- SPDR BARCLAYS CAPITAL HIGH YIELD BOND (MONTHLY)

Dividend (YTD): $14.58K

Average Monthly Dividend (YTD): $1.62K

Total Dividend Collected to Date: $106.41K

*Dividends are realized on pay date

With the addition of a satellite portfolio, some of the ETFs have started

to contribute dividends monthly.

This week, the US market was indeed volatile with Trump halting the

discussion of stimulus package to after the election. The market reacted

negatively and prices fell. But most of the investors believe that a

stimulus package is still on the way and the market rebounded soon after.

The market continues to move up as we are near the end of the week.

Although prices have not reached the peak in early September, it may attempt to reach the high again.

Market may remain volatile depending on what policies the US presidential

candidates are putting forward. It may seem like Biden is leading at the moment, but

most people also thought Hillary Clinton was leading at one point in the

last election. It is still anyone’s guess.

The Singapore market has also rebounded and the star of the week has to be

CapitaRetail China Trust. CRCT has recently updated their mandate, and is

no longer limited to holding retail assets. Investors are expecting future

acquisitions of China assets from the parent, CapitaLand, and the price has

since gone up.

On the other hand, the price of Fraser CentrePoint Trust has fallen near

to the PO price. I will be waiting until the last day before deciding on

whether to subscribe. If the price falls below the PO price, then I will

buy directly from the market and not apply for the PO.

InvestingNote Profile: @SingularityTruth

Facebook Page: @SingularityTruth

Comments

Post a Comment